Manufacturing Sales

Manufacturing Sales

October 2023

Factory Sales Drop in October, Led by Petroleum and Coal Products

HIGHLIGHTS

- Manufacturing sales fell 2.8% to $71.0 billion in October, the biggest one-month drop since February 2023.

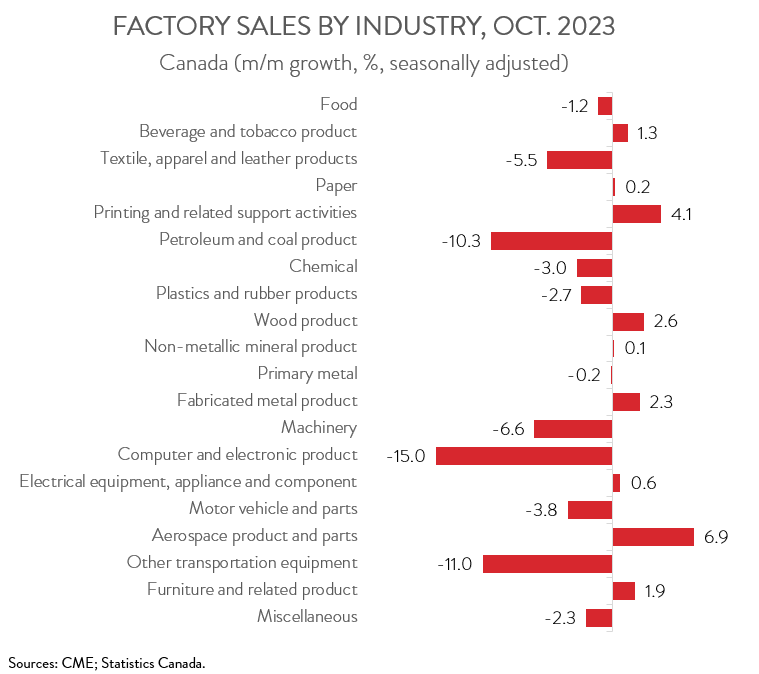

- The decrease spanned 11 of 20 subsectors, with petroleum and coal product sales posting the steepest decline.

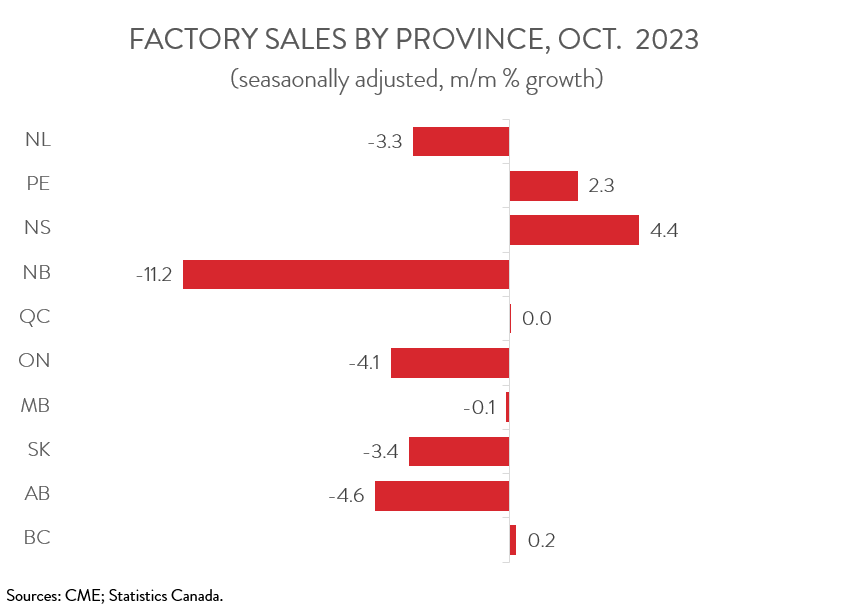

- Regionally, sales were down in 6 of 10 provinces, led by Ontario and Alberta.

- The inventory-to-sales ratio increased from 1.69 in September to 1.75 in October, the highest point since June 2020.

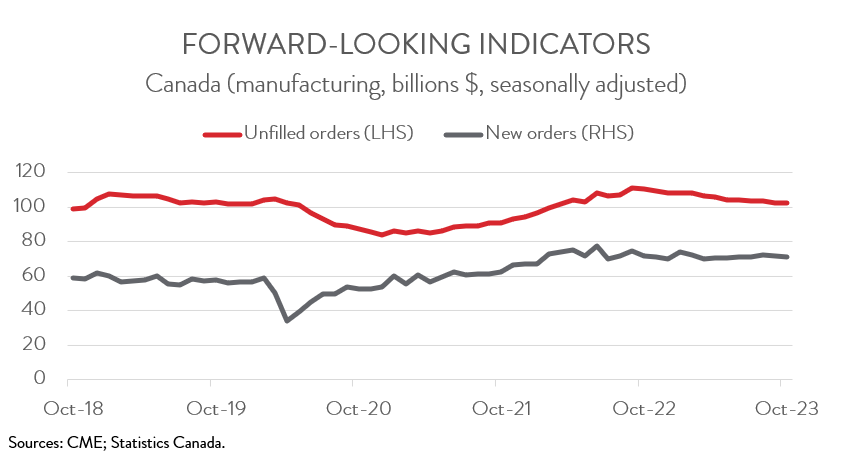

- Forward-looking indictors were mixed, with unfilled orders up 0.2% and new orders down 1.0%.

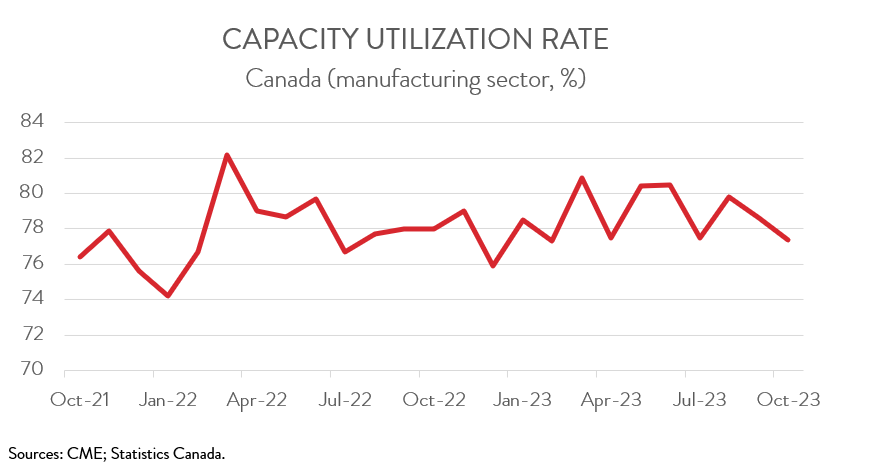

- The capacity utilization rate decreased from 78.6% in September to 77.4% in October.

- Today’s report provides further evidence that Canada’s manufacturing sector continues to be held back held back by high interest rates and a slow global economy.

MANUFACTURING SALES DOWN 2.8% IN OCTOBER

Manufacturing sales fell 2.8% to $71.0 billion in October, the biggest one-month drop since February 2023. Sales in constant dollars were down 2.2% in October, the fourth decline in five months.

Today’s report provides further evidence that Canada’s manufacturing sector continues to be held back held back by high interest rates and a slow global economy. Real factory sales, which closely track real manufacturing GDP, have decreased for three consecutive months and are down 4.3% since January.

SALES OF PETROLEUM AND COAL PRODUCTS DECREASE THE MOST

The decrease in sales in October spanned 11 of 20 industries. The petroleum and coal products industry posted the steepest decline, with sales plunging 10.3% to $8.4 billion in October. Both prices and volumes were down, with the drop in production partly the result of maintenance activities at some refineries.

Meanwhile, sales of motor vehicles and parts decreased 3.8% to $8.9 billion in October, down for the third consecutive month. According to Statistics Canada, two factors were mainly responsible for the drop in sales in October: a major auto assembly plant temporarily shut down to retool and exports to the U.S. fell due to disruptions caused by the United Auto Worker’s strike.

In more bad news, sales of machinery fell 6.6% to $4.4 billion in October, down for the first time in four months. Decreases were widespread, spanning five of seven subsectors, led lower sales of industrial machinery and agricultural, construction and mining machinery.

The declines were partially offset by a solid showing from the aerospace product and parts industry, which saw sales rise 6.9% to $2.2 billion in October. This was the third consecutive monthly gain and the highest level since March 2020. Indeed, sales have soared 25.5% over the past 12 months, as the aerospace industry continues to recover from the depths of the pandemic when air travel ground to a virtual halt.

As well, sales of fabricated metal products climbed 2.3% to $4.5 billion in October, bouncing back after falling for two straight months. Sales in constant dollars were up 1.9%, indicating a higher volume of goods sold.

SALES FALL IN SIX PROVINCES, LED BY ONTARIO AND ALBERTA

Manufacturing sales were down in 6 of 10 provinces in October. Sales in Ontario declined for the third straight month, down 4.1% to $31.5 billion in October. The decrease was primarily driven by lower sales of machinery and motor vehicles and parts.

After three consecutive monthly gains, sales in Alberta fell 4.6% to $8.8 billion in October 2023, as lower sales of petroleum and coal products more than offset higher sales of food products.

On a positive note, sales in Nova Scotia rose 4.4% to $914.6 million in October, led by higher sales of aerospace products and parts and food products.

INVENTORY-TO-SALES RATIO RISES

Total inventories increased 0.7% to $123.8 billion in October, the second consecutive monthly gain, led by the transportation equipment, beverage and tobacco, and computer and electronic product subsectors. The gains were partially offset by lower inventories of machinery.

With inventories up and sales down, the inventory-to-sales ratio increased from 1.69 in September to 1.75 in October, the highest point since June 2020. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS MIXED

Forward-looking indictors were mixed. The total value of unfilled orders edged up 0.2% to $102.4 billion in October, primarily due to higher unfilled orders of aerospace products and parts. On the other hand, new orders decreased 1.0% to $71.2 billion in October, down for the second month in a row.

CAPACITY UTILIZATION RATE DECREASES

Finally, the manufacturing sector’s capacity utilization rate decreased from 78.6% in September to 77.4% in October. The most notable declines were observed in the petroleum and coal product, food, and beverage and tobacco subsectors, while the most significant increase was recorded in the wood product industry.