Manufacturing Sales

Manufacturing Sales

November 2023

Manufacturing Sales Increase in November, but Near-Term Outlook Remains Cloudy

HIGHLIGHTS

- Manufacturing sales rose 1.2% to $71.7 billion in November, the fourth increase in five months.

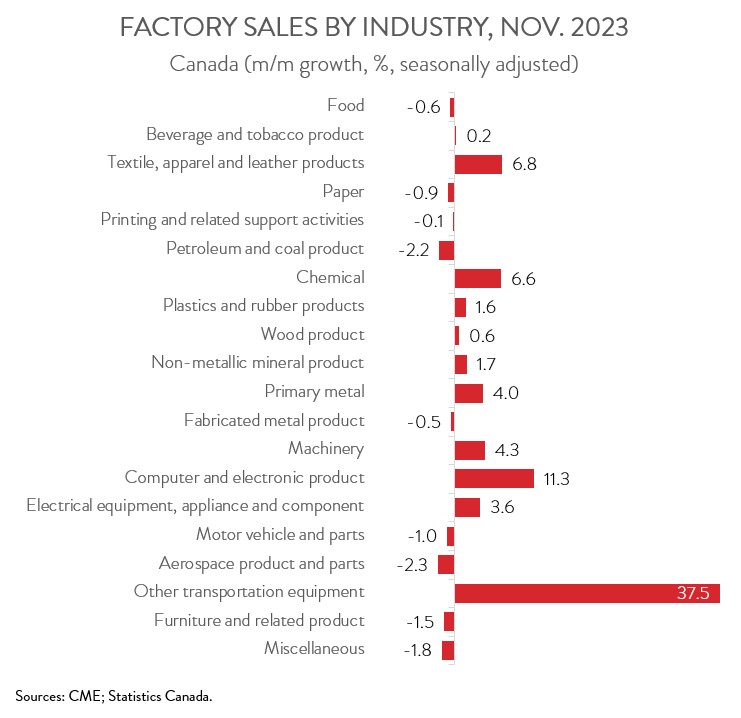

- The increase spanned 11 of 20 subsectors, led by strong contributions from the chemical, primary metal, and machinery industries.

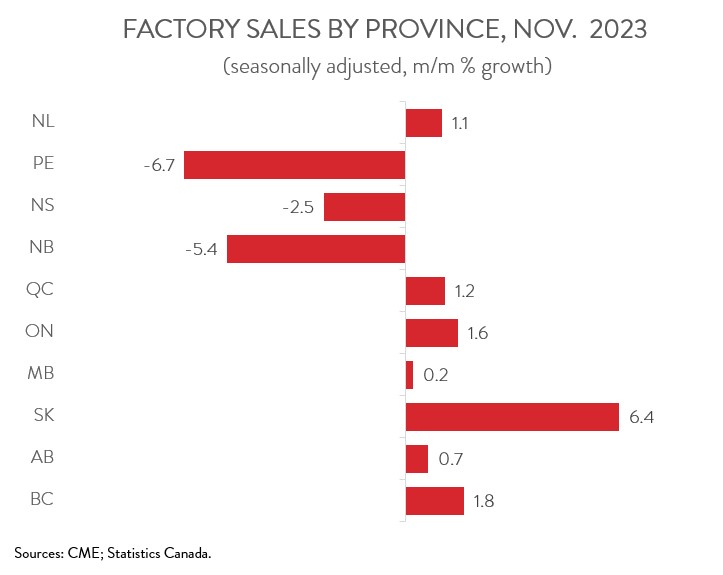

- Regionally, sales were up in 7 of 10 provinces, with Ontario posting the biggest increase and New Brunswick recording the largest decline.

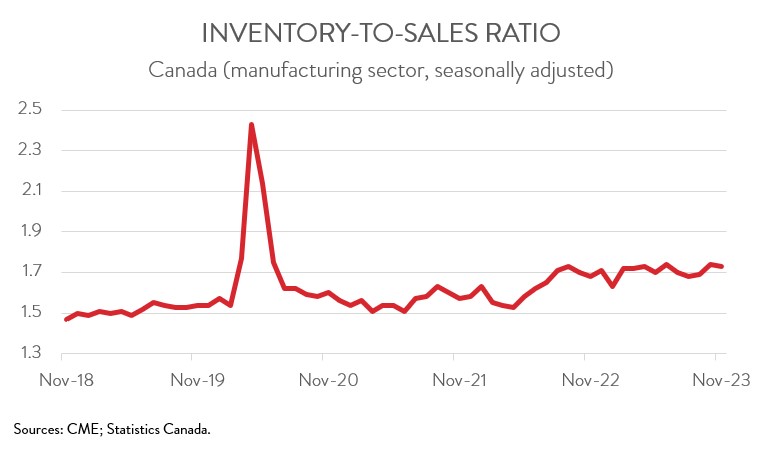

- The inventory-to-sales ratio inched down from 1.74 in October to 1.73 in November.

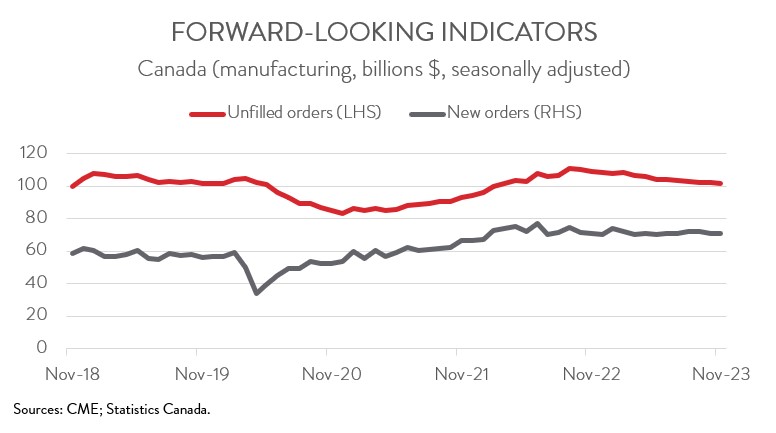

- Forward-looking indictors were discouraging, with unfilled orders and new orders down 0.8% and 0.3%, respectively.

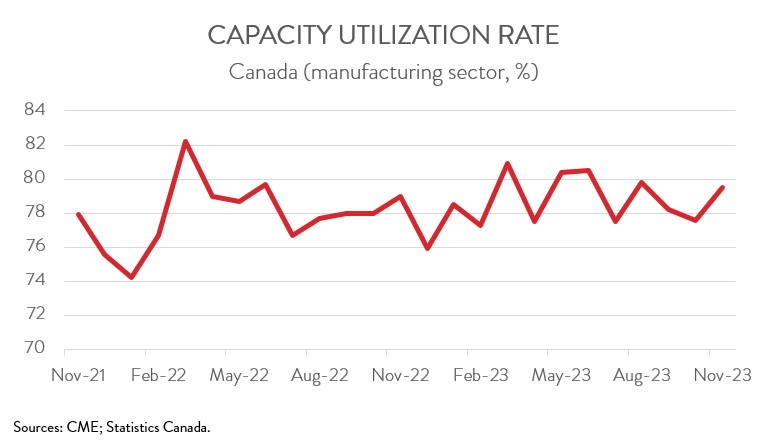

- The capacity utilization rate increased from 77.6% in October to 79.5% in November.

- Despite the positive headline in today’s report, the underlying details were less reassuring, especially the recent pullback in forward-looking indicators.

FACTORY SALES UP FOR FOURTH TIME IN FIVE MONTHS

Manufacturing sales rose 1.2% to $71.7 billion in November, the fourth increase in five months. In more good news, sales in constant dollars, which closely track real manufacturing GDP, climbed 1.6% during the month.

Despite the positive headline in today’s report, the underlying details were less reassuring, especially the recent pullback in forward-looking indicators. Moreover, most forecasts predict that the world economy will slow in 2024, which is typically bad news for the trade-oriented manufacturing sector.

SALES INCREASE LED BY LED BY CHEMICAL, PRIMARY METAL, AND MACHINERY INDUSTRIES

The increase in sales in November spanned 11 of 20 industries. The chemical industry contributed the most to the growth, with sales rising 6.6% to $5.6 billion, up for the first time since July 2023. As noted by Statistics Canada, production at several petrochemical plants returned to normal following shutdowns that began in September.

Following three straight monthly declines, primary metal sales climbed 4.0% to $5.6 billion in November, mainly on higher volumes. The non-ferrous metals (except aluminum) subsector drove the increase.

The machinery industry also had a solid month, with sales up 4.3% to $4.7 billion in November, partly offsetting a sharp drop in October. Importantly, the increase came from higher volumes rather than higher prices.

On the downside, petroleum and coal product sales decreased 2.2% to $8.2 billion in November, down for the second month in a row after increasing for three consecutive months. The decline was attributable to both lower volumes and prices. Year-over-year, sales were down 19.0%.

Sales of motor vehicles and parts fell 1.0% to $8.7 billion in November, the fourth consecutive monthly decline. The continued shutdown of a major auto assembly plant in Ontario for retooling contributed the most to the decrease. Despite the recent downturn, sales of motor vehicles and parts were 20.3% higher on a year-over-year basis in November, coinciding with continued supply chain improvements.

SALES UP IN SEVEN PROVINCES, LED BY ONTARIO AND QUEBEC

Manufacturing sales were up in 7 of 10 provinces in November. After decreasing for three straight months, sales in Ontario increased 1.6% to $31.9 billion in November. Higher sales of basic chemicals and pharmaceutical and medicine products more than offset a pullback in sales of motor vehicles.

In Quebec, sales increased 1.2% to $17.9 billion in November, mainly on higher sales in the primary metal subsector as production ramped up at many non-ferrous metal plants. The increase was partly offset by lower sales of petroleum and coal products.

At the other end of the spectrum, sales in New Brunswick fell 5.4% to $1.8 billion in November, the second consecutive monthly decrease. The decline was concentrated in non-durable goods manufacturing, a subsector that produces goods that are used up entirely in less than a year, assuming a normal rate of physical usage.

INVENTORY-TO-SALES INCHES DOWN

Total inventories increased 0.5% to a record high of $124.2 billion in November. The increase was driven by higher inventories of transportation equipment, machinery, and petroleum and coal.

Accordingly, the inventory-to-sales ratio inched down from 1.74 in October to 1.73 in November. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. The total value of unfilled orders declined 0.8% to $101.5 billion in November, the fourth decline in five months. The pullback was largely attributable to lower unfilled orders of aerospace products and parts. At the same time, new orders fell 0.3% to $70.9 billion, down for the second month in a row.

CAPACITY UTILIZATION RATE INCREASES

Finally, the manufacturing sector’s capacity utilization rate increased from 77.6% in October to 79.5% in November. The most significant increases were observed in the transportation equipment, chemical, and petroleum and coal sectors, while the most notable declines were recorded in the beverage and tobacco and wood industries.