Manufacturing Sales

Manufacturing Sales

December 2023

Manufacturing Sales End 2023 on a Sour Note

HIGHLIGHTS

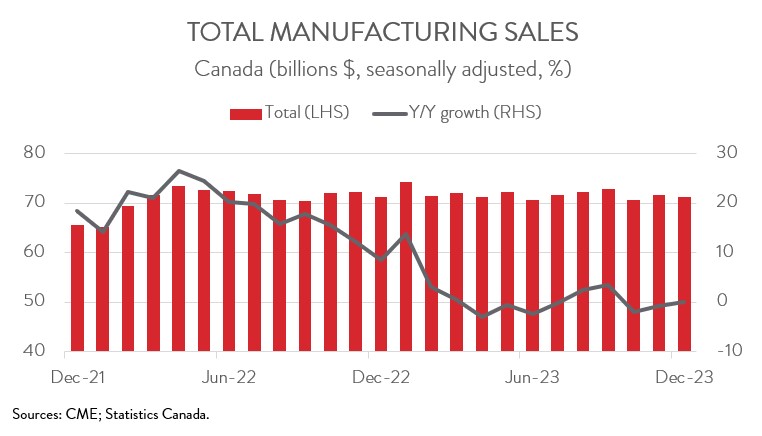

- Manufacturing sales fell 0.7% to $71.2 billion in December, down for the second time in three months.

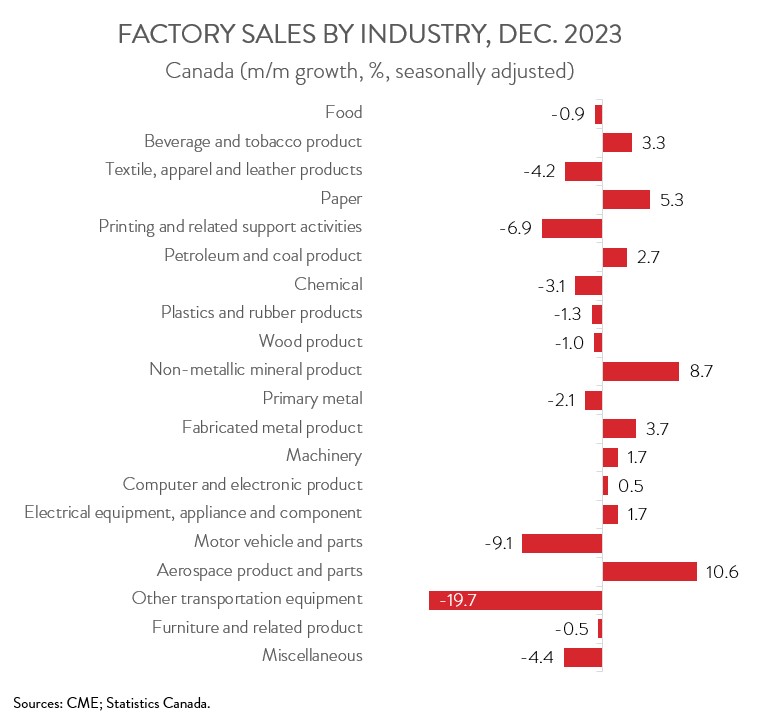

- The decrease spanned 11 of 20 subsectors, with motor vehicle and parts posting the steepest decline and aerospace product and parts recording the most impressive gain.

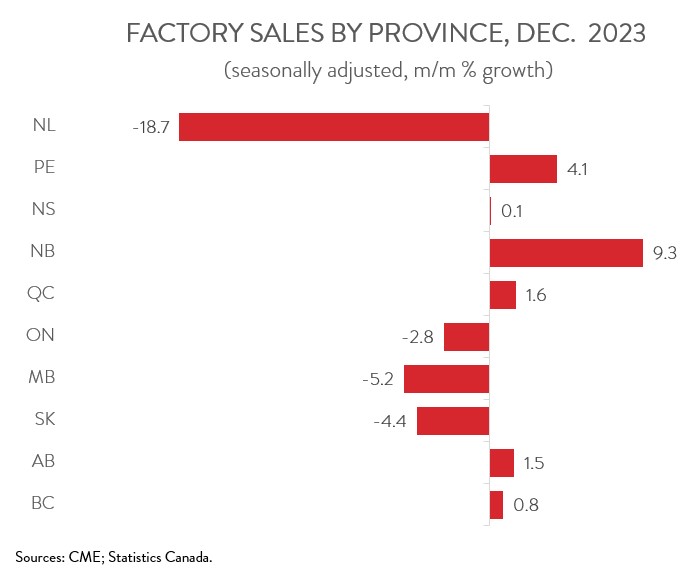

- Regionally, sales were down in 4 of 10 provinces, with the bulk of the losses concentrated in Ontario.

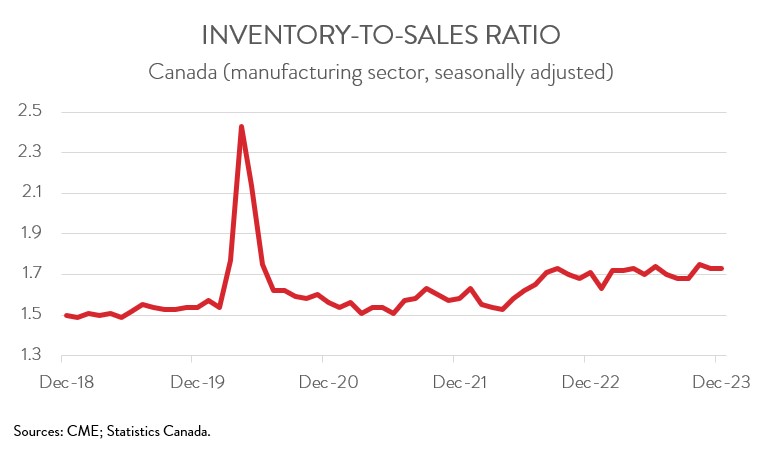

- The inventory-to-sales ratio remain unchanged at 1.73.

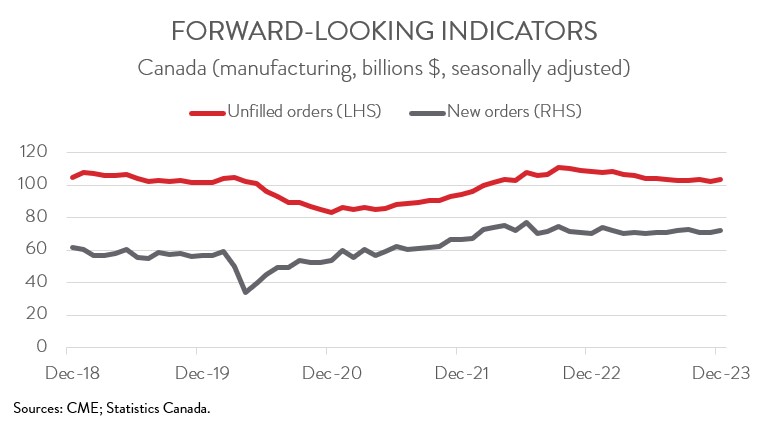

- Forward-looking indictors were encouraging, with unfilled orders and new orders up 1.2% and 2.3%, respectively.

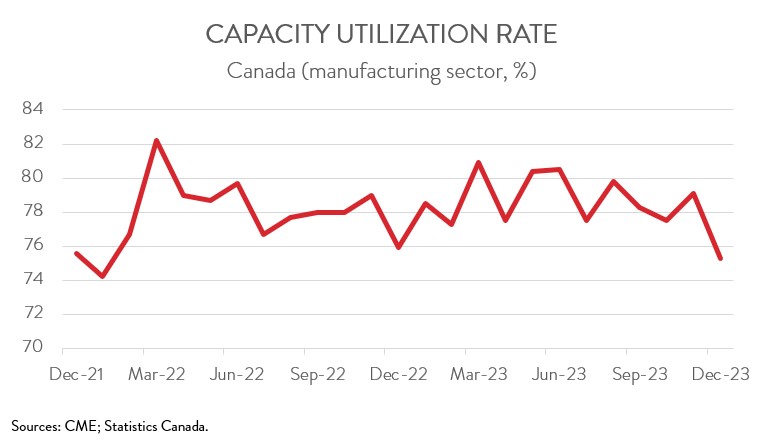

- The capacity utilization rate decreased from 79.1% in November to 75.3% in December, the lowest level since January 2022.

- The near-term outlook for the manufacturing sector remains cloudy, as high interest rates continue to weigh on demand for manufactured goods.

FACTORY SALES DOWN 0.7% IN DECEMBER

Manufacturing sales fell 0.7% to $71.2 billion in December, down for the second time in three months. Sales in constant dollars, which closely track real manufacturing GDP, edged down 0.1% during the month.

While manufacturing sales rose 1.1% to a record high of $862.8 billion in 2023, growth was much slower than the double-digit pace of the prior two years. As well, sales were down 1.6% in the fourth quarter, providing a weak hand-off to 2024. On top of that, the near-term outlook for the sector remains cloudy, as high interest rates continue to weigh on demand for manufactured goods.

SALES DECREASE DRIVEN BY AUTO SECTOR

The decrease in sales in December spanned 11 of 20 industries. Sales of motor vehicles and parts tumbled 9.1% to $7.9 billion, the fifth consecutive monthly decline and the lowest level since February 2023. Statistics Canada blamed the sales slump on production slowdowns for retooling at some auto assembly plants in Ontario.

The chemical manufacturing industry also had a tough month, as sales fell 3.1% to $5.4 billion in December, partly erasing the previous month’s gain of 6.6%. The decline was primarily driven by lower sales of pharmaceutical and medicine products.

On the positive side of the ledger, sales of aerospace products and parts soared 10.6% to an all-time high of $2.5 billion in December. All told, sales increased 14.6% in the fourth quarter, boosted by a significant increase in aircraft deliveries by some major aerospace manufacturers.

At the same time, petroleum and coal product sales increased 2.7% to $8.5 billion in December, up for the first time in three months. Although the industry experienced a 14.3% sales decline in 2023, a correction was not unexpected given that sales growth averaged a blistering 59.6% per year over 2021-22.

SALES DECLINE CONCENTRATED IN ONTARIO

Manufacturing sales were down in 4 of 10 provinces in December. Ontario contributed the most to the decline, as sales shrank 2.8% to $31.0 billion, mainly on lower sales of motor vehicles.

At the same time, sales in Manitoba fell 5.2% to $2.1 billion December, down for the third month in a row. The decrease was largely attributable to lower sales in the transportation equipment and machinery subsectors.

Decreases in those two provinces were partly offset by a solid gain in Quebec, where sales rose 1.6% to $18.3 billion in December. This was the second consecutive monthly gain and was primarily due to higher sales of aerospace products and parts.

New Brunswick also had a strong month, with sales surging 9.3% to $2.0 billion in December, partly making up for steep losses recorded in the previous two months.

INVENTORY-TO-SALES RATIO STEADY

Total inventories fell 0.6% to $123.1 billion in December. The increase was driven by lower inventories of transportation equipment, petroleum and coal, and food.

With inventories and sales both falling, the inventory-to-sales ratio remain unchanged at 1.73 in December. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS ENCOURAGING

Forward-looking indictors were encouraging. The total value of unfilled orders rose 1.2% to $103.7 billion in December, the biggest one-month gain since September 2022. At the same time, new orders jumped 2.3% to $72.4 billion, the largest monthly increase since January 2023.

CAPACITY UTILIZATION RATE DECREASES

Finally, the manufacturing sector’s capacity utilization rate decreased from 79.1% in November to 75.3% in December, the lowest level since January 2022. The most significant declines were observed in the transportation equipment and food sectors, while the most notable increase was recorded in the petroleum and coal product industry.