Manufacturing Sales

Manufacturing Sales

January 2024

Manufacturing Sales Edge Up in January

HIGHLIGHTS

- Manufacturing sales rose 0.2% to $71.1 billion in January, following a 1.1% decline in the previous month.

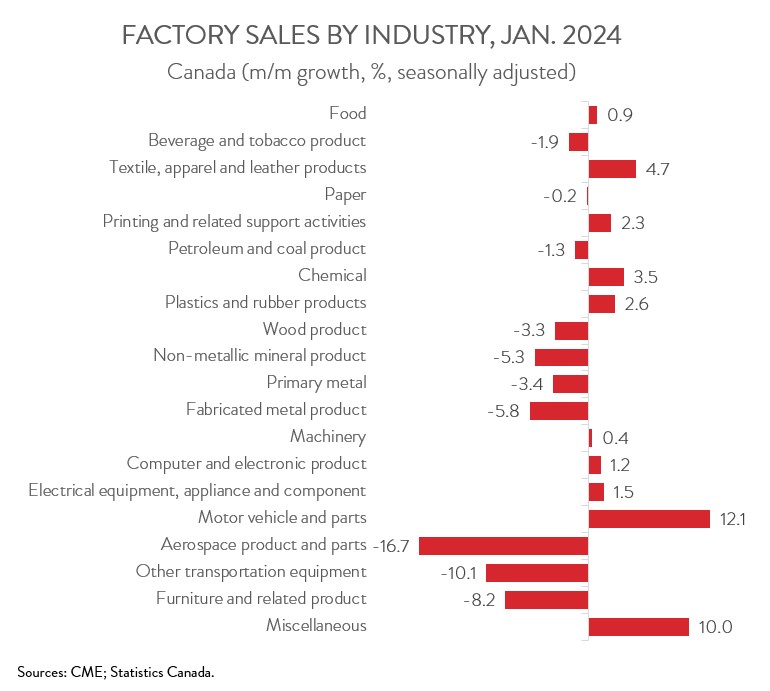

- The increase spanned 10 of 20 subsectors, with motor vehicle and parts posting the most impressive gain and aerospace product and parts recording the steepest loss.

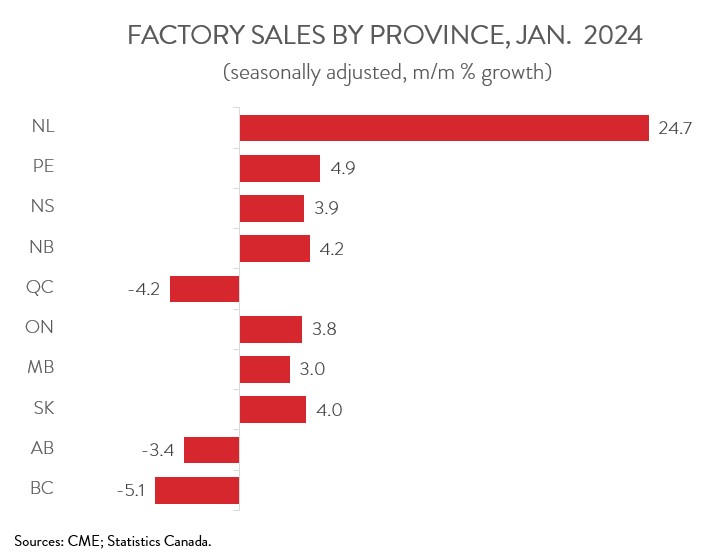

- Regionally, sales were up in 7 of 10 provinces, with the bulk of the gain concentrated in Ontario.

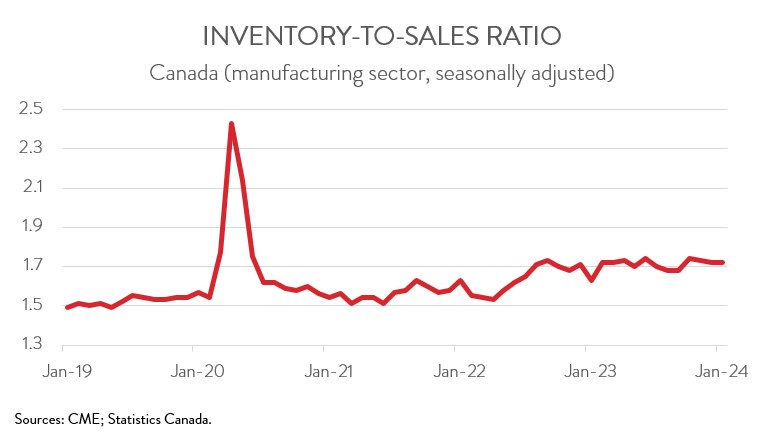

- The inventory-to-sales ratio remain unchanged at 1.72.

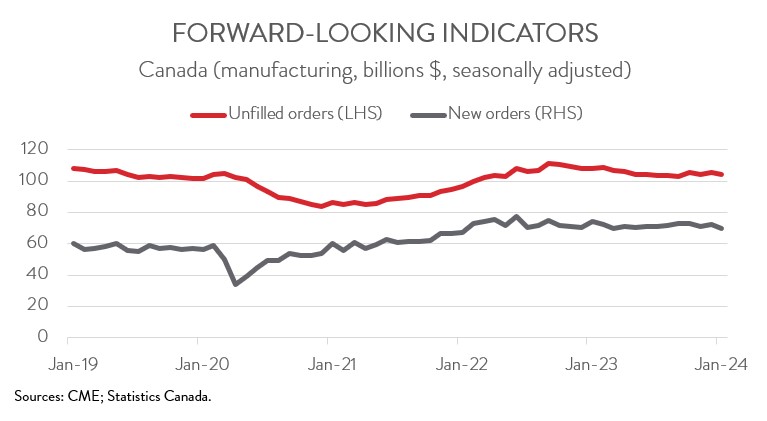

- Forward-looking indictors were discouraging, with unfilled orders and new orders down 1.3% and 3.1%, respectively.

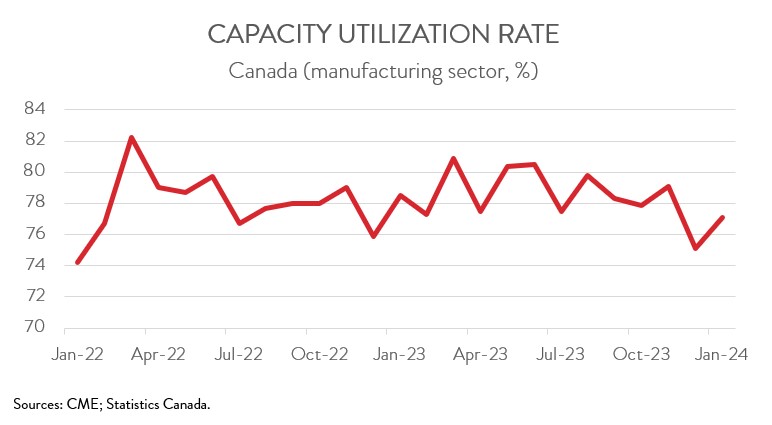

- The capacity utilization rate increased from 75.1% in December to 77.1% in January.

- The near-term outlook for Canada’s manufacturing sector remains cloudy, as high interest rates continue to weigh on demand for manufactured goods at both home and abroad.

FACTORY SALES UP 0.2% IN JANUARY

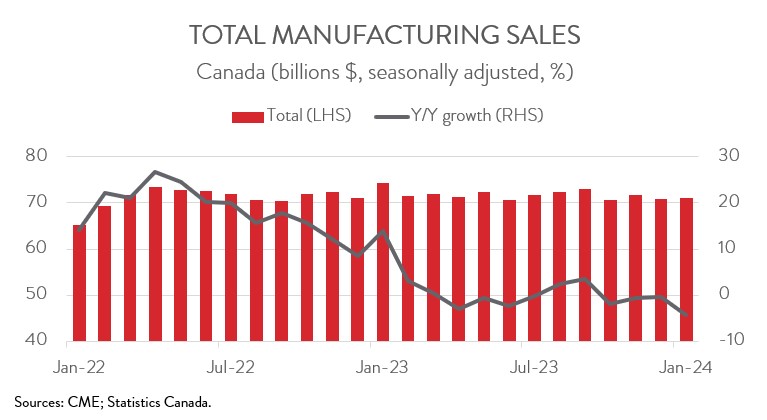

Manufacturing sales rose 0.2% to $71.1 billion in January, following a 1.1% decline in the previous month. Sales in constant dollars, which closely track real manufacturing GDP, increased 1.1% during the month, up for the second time in three months.

Despite the uptick in January, manufacturing sales were down 4.3% on a year-over-year basis, reflecting the sector’s recent struggles. Unfortunately, the near-term outlook for Canada’s manufacturing sector remains cloudy, as high interest rates continue to weigh on demand for manufactured goods at both home and abroad.

SALES INCREASE DRIVEN BY AUTO SECTOR

The increase in sales in January spanned 10 of 20 industries. Sales of motor vehicles and parts jumped 12.1% to $8.8 billion, up for the first time in six months. As noted by Statistics Canda, production resumed in some auto assembly plants in January after several months of downtime for retooling in 2023.

The chemical manufacturing industry also had a good month, as sales rose 3.5% to $5.6 billion in January, more than making up for the 2.8% decline in the previous month. Gains were widespread across six of the seven subsectors, led by pesticide, fertilizer and other agricultural chemical manufacturing.

Increases in those sectors were partly offset by a significant pullback in the aerospace product and parts industry. After hitting a record high in December, the industry’s sales dropped 16.7% to $2.1 billion in January.

SALES INCREASE CONCENTRATED IN ONTARIO

Manufacturing sales were up in 7 of 10 provinces in January. Ontario contributed the most to the increase, as sales rose 3.8% to $32.2 billion, led by higher sales of motor vehicles and chemical products.

At the same time, sales in New Brunswick increased 4.2% to $2.1 billion, largely on higher sales of non-durable goods. However, despite the increase, sales were 6.1% lower than in the same month last year.

In more good news, sales in Newfoundland and Labrador surged 24.7% to $290.4 million in January, the biggest one-month advance since May 2021. Nevertheless, the province’s sales were still down 12.6% on a year-over-year basis.

On the negative side, sales in Quebec fell 4.2% to $17.3 billion in January, down for the first time in three months. The decline was driven by lower sales of aerospace products and parts and primary metals.

INVENTORY-TO-SALES RATIO STEADY

Total inventories fell 0.2% to $122.1 billion in January, the second consecutive monthly decline. The decrease was driven mainly by lower inventories of primary metals and petroleum and coal.

The inventory-to-sales ratio remain unchanged at 1.72 in January. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. The total value of unfilled orders fell 1.3% to $104.2 billion in January, down for the second time in three months. The decline was largely attributable to lower unfilled orders of transportation equipment.

Meanwhile, new orders dropped 3.1% to $69.8 billion in January, the lowest level in two years.

CAPACITY UTILIZATION RATE INCREASES

Finally, the manufacturing sector’s capacity utilization rate increased from 75.1% in December to 77.1% in January. The most significant gains were observed in the chemical and transportation equipment sectors, while the most notable declines were recorded in the non-metallic mineral and computer and electronic product industries.