Manufacturing Sales

Manufacturing Sales

February 2024

Manufacturing Sales Post First Increase in Three Months

HIGHLIGHTS

- Manufacturing sales rose 0.7% to $71.6 billion in February, up for the first time in three months.

- The increase spanned 13 of 20 subsectors, with petroleum and coal products increasing the most.

- Regionally, sales were up in 5 of 10 provinces, led by Quebec and Alberta.

- The inventory-to-sales ratio decreased from 1.71 in January to 1.68 in February.

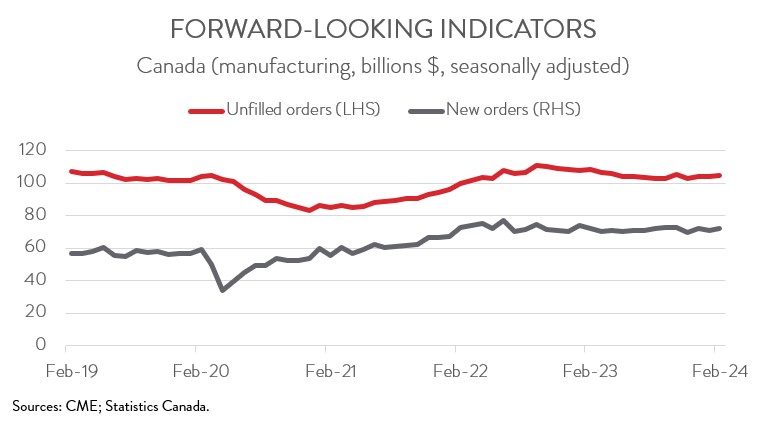

- Forward-looking indictors were encouraging, with unfilled orders and new orders up 0.8% and 1.9%, respectively.

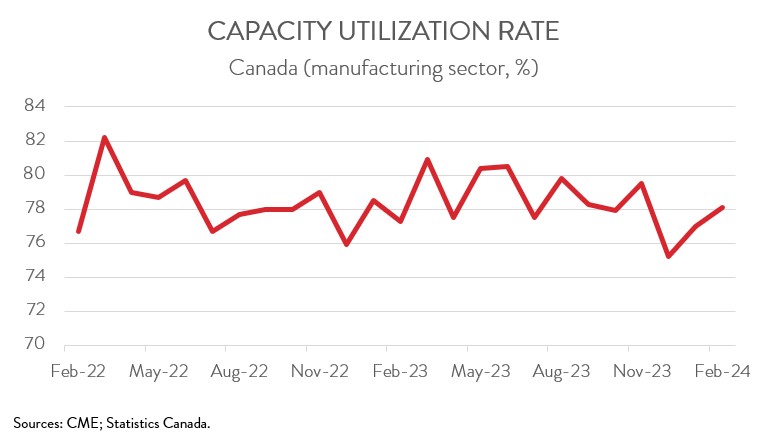

- The capacity utilization rate increased from 77.0% in January to 78.1% in February.

- While the near-term outlook for Canada’s export-oriented manufacturing sector remains uncertain due to high interest rates dampening demand, today’s report adds to signs that the global economy is gradually improving.

FACTORY SALES UP 0.7% IN FEBRUARY

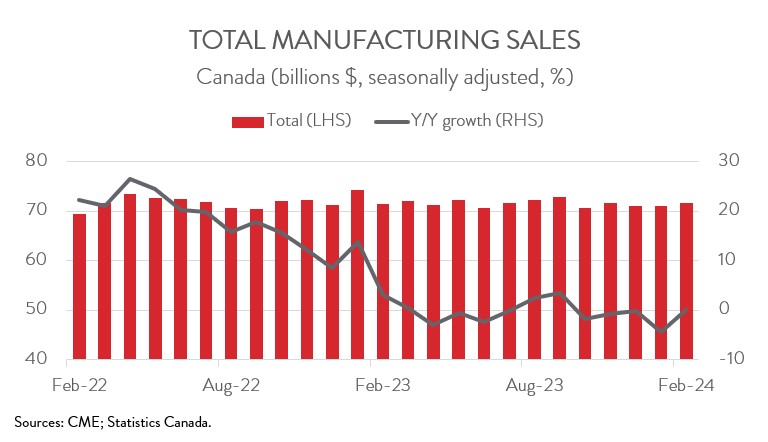

Manufacturing sales rose 0.7% to $71.6 billion in February, up for the first time in three months. Sales in constant dollars, which closely track real manufacturing GDP, edged up 0.1% during the month, the third increase in four months.

Despite the gain in February, manufacturing sales were up a mere 0.1% on a year-over-year basis, reflecting the sector’s recent struggles. However, while the near-term outlook for Canada’s export-oriented manufacturing sector remains uncertain due to high interest rates dampening demand, today’s report adds to signs that the global economy is gradually improving.

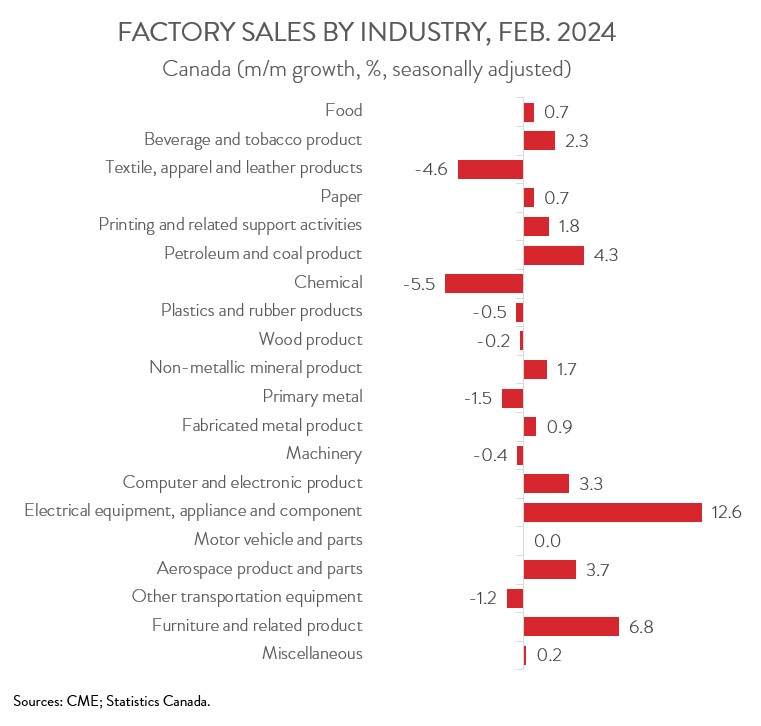

SALES INCREASE DRIVEN BY PETROLEUM AND COAL PRODUCTS

The increase in sales in February spanned 13 of 20 industries. Sales of petroleum and coal products increased the most, rising 4.3% to $8.7 billion. The gain was primarily due to higher prices and to a lesser extent, volumes.

Sales of electrical equipment, appliance and component products jumped 12.6% to $1.5 billion in February, the largest monthly increase since May 2020 and the highest level on record. The gain was mainly driven by the electrical equipment industry group.

Gains in those industries were partly offset by a pullback in sales of chemical products, which fell 5.5% to $5.3 billion in February. The decline was mainly attributable to lower sales of pesticide, fertilizer and other agricultural chemical products. Notably, prices of fertilizers, pesticides and other chemical products have decreased for four straight months.

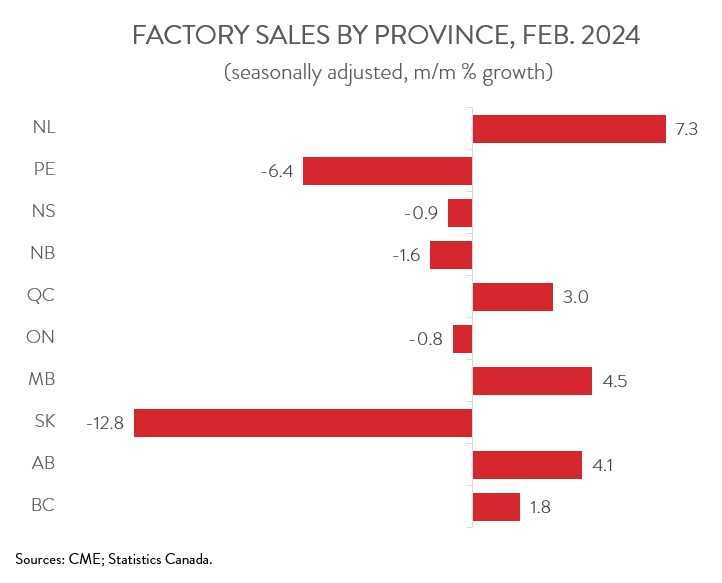

SALES INCREASE CONCENTRATED IN QUEBEC AND ALBERTA

Manufacturing sales were up in 5 of 10 provinces in February. Quebec led the way, with sales rising 3.0% to $18.0 billion. The increase was driven by higher sales of electrical equipment, appliances, and components as well as aerospace products and parts, with lower sales of machinery acting as a partial offset.

Alberta was another growth leader, as sales climbed 4.1% to $8.8 billion in February. The biggest gains were observed in the petroleum and coal and chemical subsectors.

On the downside, sales in Saskatchewan plunged 12.8% to $1.9 billion in February, the largest one-month drop since June 2023. From an industry perspective, lower sales of chemical products and machinery more than offset higher sales of petroleum and coal products.

INVENTORIES FALL FOR THIRD STRAIGHT MONTH

Total inventories decreased 0.7% to $120.6 billion in February, the third consecutive monthly decline. The decrease was mainly driven by lower inventories of chemicals and petroleum and coal products. This, combined with higher sales, drove down the inventory-to-sales ratio from 1.71 in January to 1.68 in February. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS ENCOURAGING

Forward-looking indictors were encouraging. The total value of unfilled orders rose 0.8% to $105.1 billion in February, thanks largely to a solid increase in unfilled orders of aerospace products and parts. Meanwhile, new orders climbed 1.9% to $72.5 billion in February, more than making up for the 1.4% decline in the previous month.

CAPACITY UTILIZATION RATE INCREASES

Finally, the manufacturing sector’s capacity utilization rate increased for the second month in a row, rising from 77.0% in January to 78.1% in February. The most significant gains were observed in the machinery, transportation equipment, and food subsectors, while the most notable declines were recorded in the primary metal and paper product industries.