International Trade

Merchandise Trade

June 2022

Exports Rise for Sixth Straight Month; Trade Surplus Widens to $5.0 Billion

HIGHLIGHTS

- Canadian merchandise exports rose 2.0% to $69.9 billion in June, while merchandise imports climbed 1.7% to $64.9 billion.

- Canada’s merchandise trade surplus widened from $4.8 billion in May to $5.0 billion in June, the largest trade surplus since August 2008.

- After removing price effects, export volumes were up 2.2% and import volumes were down 0.3%.

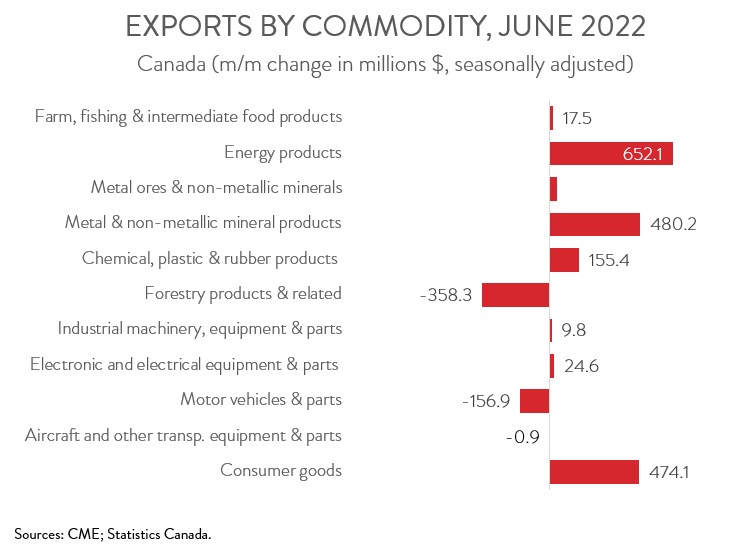

- The increase in nominal exports spanned 8 of 11 major commodity groups, led by higher exports of energy products, metal and non-metallic mineral products, and consumer goods.

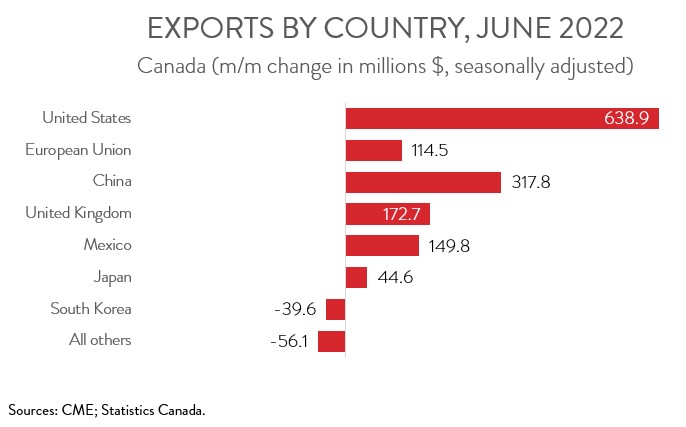

- Exports to the U.S. rose 1.2% to $53.5 billion in June, while exports to the rest of the world increased 4.5% to $16.4 billion.

- Canada’s impressive export growth performance and large trade surpluses have been largely driven by higher commodity prices. This has resulted in a disparity in growth between export values and volumes. Since the beginning of 2022, nominal exports have risen by more than 20%, while real exports are up just 0.2%. Canada’s real export activity is likely to remain tepid over the near term with the global economy facing an increasingly gloomy and uncertain outlook.

EXPORTS AND IMPORTS STAY ON UPWARD TREND

Canadian merchandise exports rose 2.0% to $69.9 billion in June, the sixth consecutive monthly increase. At the same time, imports climbed 1.7% to $64.9 billion, up for the fifth month in a row. The increase in imports was largely attributable to higher imports of energy products.

After removing price effects, export volumes were up 2.2% in June, indicating that export prices fell. This was the first decline in export prices since December 2021. In contrast, import volumes were down 0.3% in June, signalling that the increase in imports was mainly due to higher prices.

Canada’s impressive export growth performance and large trade surpluses have been largely driven by higher commodity prices. This has resulted in a disparity in growth between export values and volumes. Since the beginning of 2022, nominal exports have risen by more than 20%, while real exports are up just 0.2%. Canada’s real export activity is likely to remain tepid over the near term with the global economy facing an increasingly gloomy and uncertain outlook.

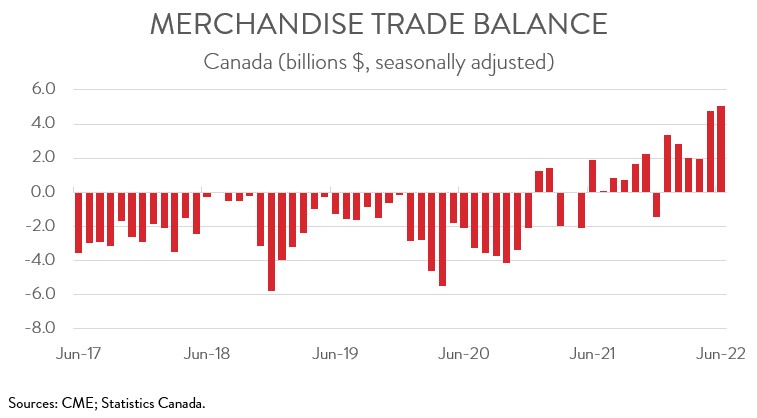

CANADA’S TRADE SURPLUS WIDENS

Canada’s merchandise trade surplus widened from $4.8 billion in May to $5.0 billion in June, the largest trade surplus since August 2008. Breaking these data down, our trade surplus with the U.S. narrowed from $13.6 billion in May to $13.2 billion in June, still the second-highest surplus on record. At the same time, our trade deficit with the rest of the world narrowed from $8.8 billion to $8.2 billion.

MOST PRODUCT CATEGORIES SEE INCREASE IN EXPORTS

The increase in exports was widespread, spanning 8 of 11 product categories. Exports of energy products contributed the most to the growth, rising 3.2% to $21.0 billion in June, the sixth straight monthly advance. As a result, energy products accounted for 30.0% of total exports for the month, a record high for this product category.

Non-energy exports also had a strong month, up 1.4% to $48.9 billion in June, up for the fifth consecutive month. Exports of metal and non-metallic mineral products rose 6.5% to $7.9 billion in June. The growth was driven mainly by exports of unwrought gold, silver, and platinum group metals, and their alloys—a category mainly composed of unwrought gold.

Exports of consumer goods climbed 6.3% to $8.0 billion in June, mainly attributable to a strong increase in exports of pharmaceutical products. According to Statistics Canada, large quantities of COVID-19 medications were exported to the U.S., Australia, and the Netherlands in June.

On the downside, exports of forestry products and building and packaging materials fell 6.6% to $5.1 billion in June, down for the first time in six months. The decline was largely due to lower lumber exports, mainly on lower prices. Statistics Canada attributed the decline in prices to reduced demand for lumber from the U.S. residential construction industry.

At the same time, exports of motor vehicles and parts fell 2.3% to $6.5 billion, the second straight monthly decline, as supply chain issues continued to weigh on auto production.

CANADIAN EXPORTS TO THE U.S. INCREASE FOR SIXTH STRAIGHT MONTH

Exports to the U.S. climbed 1.2% to $53.5 billion in June, up for the sixth month in a row. At the same time, exports to the rest of the world rose 4.5% to a record high of $16.4 billion. Among Canada’s major non-U.S. trading partners, exports to China, the U.K., Mexico, the EU, and Japan were up, while exports to South Korea were down. The increase in exports to China was powered by higher exports of coal, copper, and potash.