International Trade

Merchandise Trade

May 2023

Canada’s Trade Balance Swings to a Deficit in May, as Imports Jump and Exports Fall

HIGHLIGHTS

- Canada’s merchandise exports decreased 3.8% to $61.5 billion in May, while imports increased 3.0% to $65.0 billion.

- As a result, the country’s trade balance swung sharply from a surplus of $894 million in April to a deficit of $3.4 billion in May, the largest deficit since October 2020.

- In volume terms, real exports were down 2.5% and real imports were up 3.5%.

- The decrease in nominal exports spanned 7 of 11 product sections, led by lower exports of crude oil and wheat.

- Exports to the U.S. fell 2.9% to $47.4 billion in May and exports to the rest of the world contracted 6.6% to $14.1 billion.

- The near-term trade outlook remains uncertain. While a ramp up in oil production in Alberta following a huge wildfire should provide a lift to exports in June, the B.C. port strike will weigh down trade activity in July.

EXPORTS DOWN 3.8% IN MAY

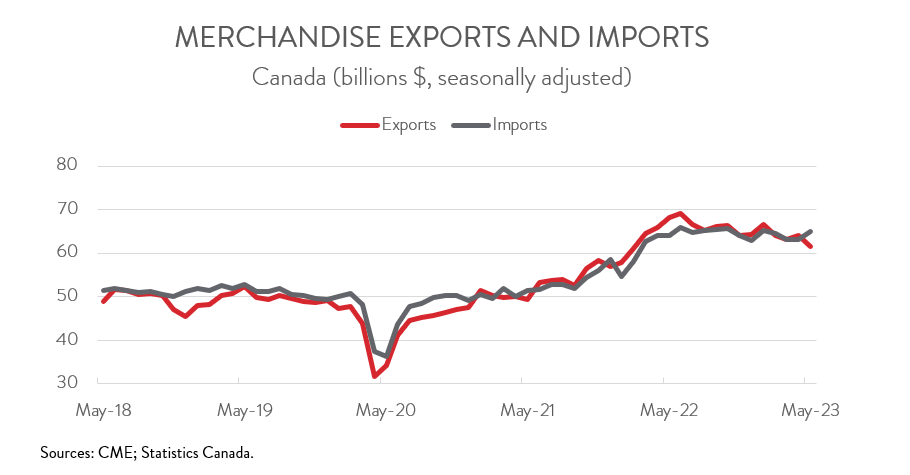

Canada’s merchandise exports decreased 3.8% to $61.5 billion in May, while imports increased 3.0% to $65.0 billion. The picture was similarly gloomy in volume terms, with real exports down 2.5% and real imports up 3.5%.

Export volumes have decreased in three out of the last four months, indicating that Canadian exporters are feeling the pinch of slowing global economic growth. Unfortunately, the near-term trade outlook remains uncertain. While a ramp up in oil production in Alberta following a huge wildfire should provide a lift to exports in June, the B.C. port strike will weigh down trade activity in July.

CANADA POSTS LARGEST TRADE DEFICIT SINCE OCTOBER 2020

The country’s trade balance swung sharply from a surplus of $894 million in April to a deficit of $3.4 billion in May, the largest deficit since October 2020. Breaking the numbers down, Canada’s trade surplus with the U.S. narrowed from $8.7 billion in April to $6.7 billion in May, while our trade deficit with the rest of the world widened from $7.8 billion to $10.2 billion.

EXPORTS DRAGGED DOWN CRUDE OIL AND WHEAT

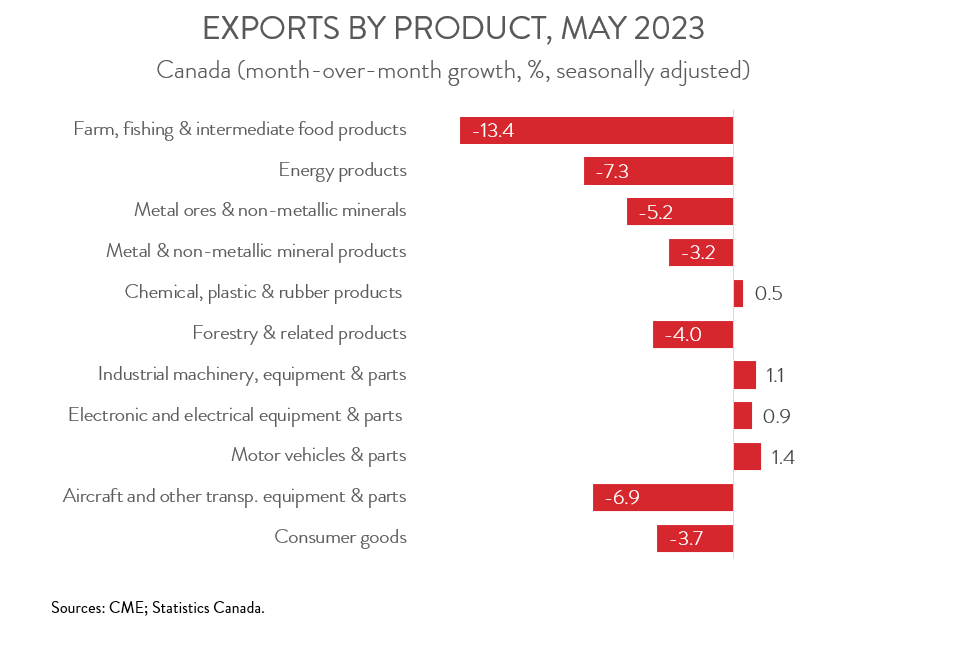

The decrease in exports spanned 7 of 11 product sections. Exports of energy products fell the most, declining 7.3% to $12.1 billion in May. Crude oil exports contributed the most to the decline, with the drop mainly the result of lower prices. The benchmark West Texas Intermediate (WTI) price of oil averaged US$71.58 a barrel in May, down from US$79.45 a barrel in April.

Exports of farm, fishing and intermediate food products decreased 13.4% to $4.5 billion in May, down for the third month in a row. According to Statistics Canada, demand for Canadian grains has slowed in recent months amid improving global supplies, especially for wheat and canola, resulting in lower prices.

On a positive note, exports of motor vehicles and parts climbed 1.4% to $8.7 billion in May, up for the second month in a row. This brought the year-over-year gain to 23.5%, fastest among all 11 product sections, reflecting continued improvement in supply chains.

EXPORTS TO THE U.S. DOWN FOR THIRD TIME IN FOUR MONTHS

Exports to the U.S. fell 2.9% to $47.4 billion in May, down for the third time in four months. The decrease was partly attributable to lower exports of crude oil.

At the same time, exports to the rest of the world declined 6.6% to $14.1 billion in May, the lowest level since January 2022. Among Canada’s major non-U.S. trading partners, exports to the U.K., South Korea, Japan, and the EU were down, while exports to China and Mexico were up. The decrease in exports to the U.K. was driven by gold, while the increase in exports to China was powered by articles of precious metals and iron ores.