International Trade

Merchandise Trade

June 2023

Canada’s Trade Deficit Widens in June, as Exports Fall for Second Straight Month

HIGHLIGHTS

- Canada’s merchandise exports decreased 2.2% to $60.7 billion in June, while imports edged down 0.5% to $64.4 billion.

- As a result, the country’s trade deficit widened from $2.7 billion in May to $3.7 billion in June.

- In volume terms, real exports were down 1.1% and real imports were up 0.9%.

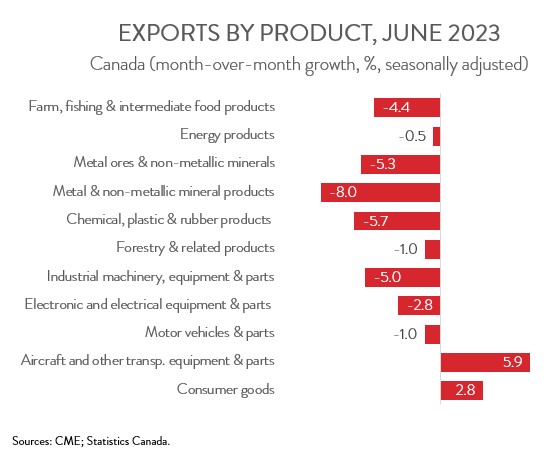

- The decline in nominal exports was widespread, spanning 9 of 11 product sections, with exports of metal and non-metallic mineral products decreasing the most.

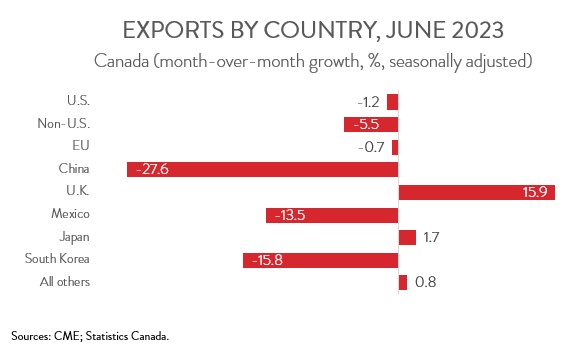

- Exports to the U.S. fell 1.2% to $47.4 billion in June and exports to the rest of the world contracted 5.5% to $13.3 billion.

- Export volumes declined by an annualized 2.9% in the second quarter, and the near-term outlook is similarly subdued, with the B.C. port strike and the floods in Nova Scotia likely to weigh down July’s trade figures.

EXPORTS DOWN 2.2% IN JUNE

Canada’s merchandise exports decreased 2.2% to $60.7 billion in June, down for the second month in a row and the fourth time in five months. Meanwhile, imports edged down 0.5% to $64.4 billion in June, following a healthy 3.0% increase in May. The picture was similarly gloomy after stripping out price effects, with real exports down 1.1% and real imports up 0.9%.

Today’s trade report offers fresh evidence that Canadian exporters continue to feel the pinch of slowing global economic growth. Export volumes have declined for two consecutive months and were down by an annualized 2.9% in the second quarter. With import volumes eking out a modest gain, net trade looks to have acted as a slight drag on the economy in Q2. Unfortunately, the near-term trade outlook is similarly subdued, as the recent downturn in exports is providing a weak hand-off to the third quarter. To make matters worse, July’s trade figures will likely be weighed down by the B.C. port strike and the floods in Nova Scotia.

CANADA’S TRADE BALANCE FALLS FURTHER INTO THE RED

The country’s trade balance remained in deficit for the second consecutive month, widening from $2.7 billion in May to $3.7 billion in June. Breaking the numbers down, Canada’s trade surplus with the U.S. narrowed from $7.7 billion in May to $7.4 billion in June, while our trade deficit with the rest of the world widened from $10.4 billion to a record high of $11.2 billion.

EXPORT DECLINE WIDESPREAD ACROSS PRODUCT SECTIONS

The decline in exports was widespread, spanning 9 of 11 product sections. Exports of metal and non-metallic mineral products decreased the most, down 8.0% to $7.2 billion in June. In particular, exports of unwrought gold fell sharply in the month, the result of both lower exports of refined gold and lower gold asset transfers in the banking sector.

Several other product sections experienced smaller, but still significant, declines. Exports of industrial machinery, equipment and parts decreased 5.0% to $4.1 billion in June, down for the first time in four months. Meanwhile, after advancing for three consecutive months, exports of basic and industrial chemical, plastic and rubber products decreased 5.7% to $3.3 billion. Finally, exports of farm, fishing and intermediate food products contracted 4.4% to $4.3 billion in June, driven by lower exports of canola and intermediate food products.

Only two product sections bucked the trend and recorded higher exports in June. Exports of consumer goods rose 2.8% to $7.5 billion, while exports of aircraft and other transportation equipment and parts climbed 5.9% to $2.6 billion. The aerospace sector continues to recover from the devastating impact of the pandemic, with exports rising by one-quarter over the last year.

EXPORTS TO THE U.S. DOWN FOR FOURTH TIME IN FIVE MONTHS

Exports to the U.S. fell 1.2% to $47.4 billion in June, down for the fourth time in five months. The decline was partly attributable to a decline in gold shipments. At the same time, exports to the rest of the world contracted 5.5% to $13.3 billion. Among Canada’s major non-U.S. trading partners, exports to China, Mexico, South Korea, and the EU were down, while exports to the U.K. and Japan were up. This was the largest monthly drop in exports to China since January 2019.