International Trade

Merchandise Trade

August 2023

Canada Posts First Trade Surplus in Four Months, as Exports Rise Sharply

HIGHLIGHTS

- Canada’s merchandise exports increased 5.7% to $64.6 billion in August, while imports rose 3.8% to $63.8 billion.

- The country’s trade balance improved from a deficit of $437 million in July to a surplus of $718 million in August, the first surplus in four months.

- In volume terms, exports and imports were up 2.1% and 2.6%, respectively.

- The increase in nominal exports spanned 7 of 11 product sections and was driven by a surge in exports of gold and crude oil.

- Exports to the U.S. rose 5.2% to $50.7 billion in August, while exports to the rest of the world climbed 7.7% to $13.9 billion.

- The sharp rise in trade activity in August was to be expected following the B.C. port strike in the prior month. However, excluding gold and crude oil, exports were essentially unchanged in August.

EXPORTS UP 5.7% IN AUGUST

Canada’s merchandise exports increased 5.7% to $64.6 billion in August, building on the 1.5% gain seen in July. Meanwhile, merchandise imports rose 3.8% to $63.8 billion, bouncing back from the 5.4% plunge in the prior month. Trade activity was also healthy in volume terms, with real exports and real imports up 2.1% and 2.6%, respectively.

The sharp rise in trade activity in August was to be expected following the B.C. port strike in the prior month. Although international trade is on track to contribute positively to Canada’s third quarter GDP, we could see a pullback in the fourth quarter as the global economy continues to limp along in the wake of high interest rates and other headwinds.

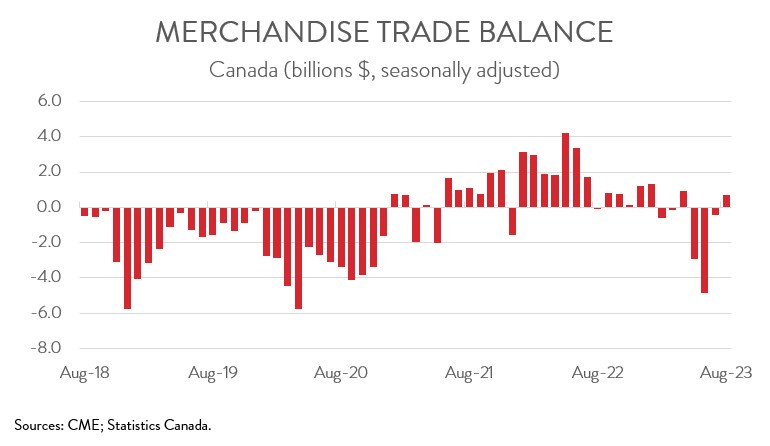

TRADE BALANCE SWINGS BACK TO A SURPLUS

Canada’s trade balance improved from a deficit of $437 million in July to a surplus of $718 million in August, the first surplus in four months. Breaking the numbers down, Canada’s trade surplus with the U.S. widened from $8.2 billion in July to $10.4 billion in August, while our trade deficit with the rest of the world widened from $8.6 billion to $9.7 billion.

EXPORT INCREASE DRIVEN BY GOLD AND CRUDE OIL

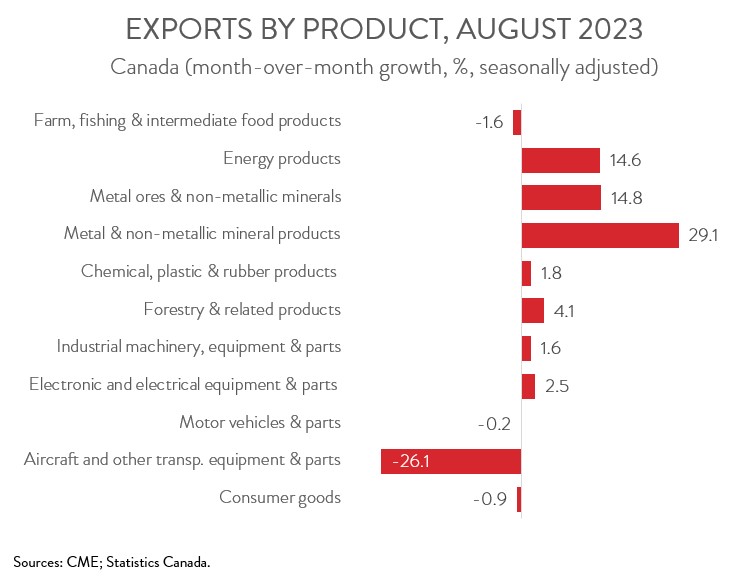

The increase in exports spanned 7 of 11 product sections and was driven by higher exports of gold and crude oil. In fact, excluding these two commodities, exports were essentially unchanged in August.

Following three consecutive months of large declines, exports of metal and non-metallic mineral products surged 29.1% to a record high of $8.5 billion in August. Exports of unwrought gold, silver, and platinum group metals contributed the most to the increase, due to higher exports of gold.

At the same time, exports of energy products climbed 14.6% to $14.5 billion. The increase was fueled mostly by prices, which posted their biggest monthly gain since March 2022. Crude oil exports rose for a second consecutive month and was the largest contributor to the growth of this product section.

Statistics Canada also noted that the resumption of port activities in B.C. helped to drive solid increases in exports of coal, potash, and lumber, products that are typically exported from Canada’s westernmost province.

On the negative side, exports of aircraft and other transportation equipment and parts plunged 26.1% to $2.3 billion in August, more than erasing the substantial 23.6% gain observed in July. However, it should be noted that exports for this industry can be lumpy. Airplanes are not typically purchased on a regular basis and instead tend to come in large, infrequent orders that can skew the results.

EXPORTS TO MOST MAJOR TRADING PARTNERS INCREASE

Exports to the U.S. rose 5.2% to $50.7 billion in August, up for the second month in a row, though the increase was fueled largely by higher energy product prices. At the same time, exports to the rest of the world climbed 7.7% to $13.9 billion. Among Canada’s major non-U.S. trading partners, exports to Japan, the U.K., Mexico, South Korea, and the EU were up, while exports to China were down. The increase in exports to the U.K. was driven by gold and crude oil.