International Trade

Merchandise Trade

September 2023

Canada’s Trade Surplus More than Doubled in September, Driven by Higher Exports of Energy Products

HIGHLIGHTS

- Canada’s merchandise exports increased 2.7% to $67.0 billion in September, while imports rose 1.0% to $65.0 billion.

- The country’s trade surplus more than doubled, growing from $949 million in August to $2.0 billion in September.

- In volume terms, exports and imports were up 0.2% and 1.1%, respectively.

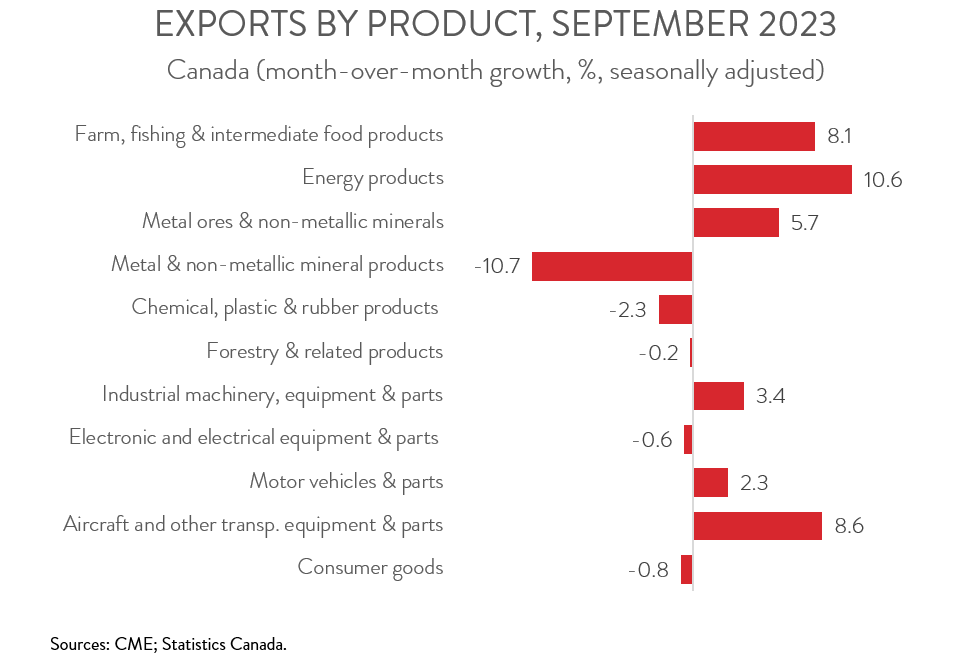

- The increase in nominal exports spanned 7 of 11 product sections and was largely driven by a double-digit gain in exports of energy products.

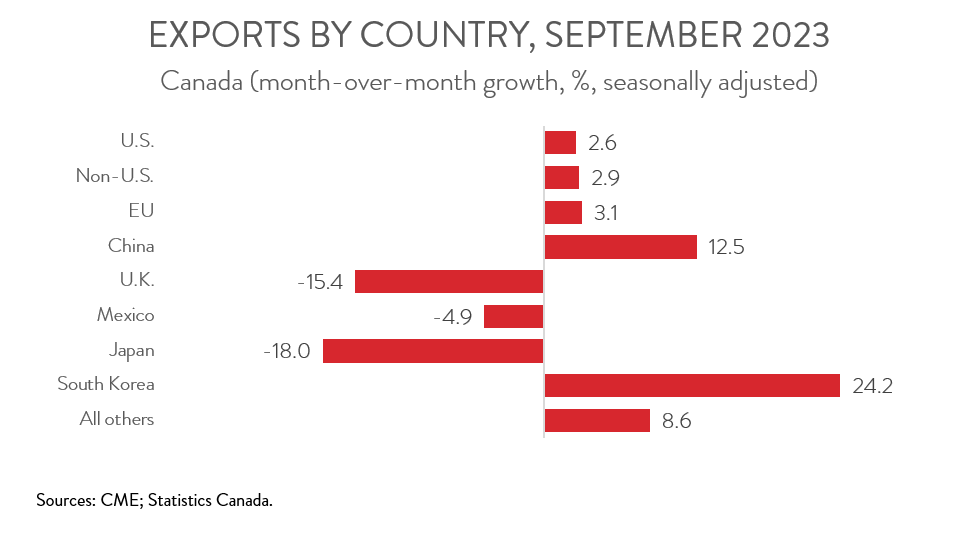

- Exports to the U.S. rose 2.6% to $52.7 billion in September, while exports to the rest of the world climbed 2.9% to $14.3 billion.

- Net trade appears to have contributed positively to GDP growth in the third quarter. As a result, Canada’s economy may have eked out a small gain in Q3 and narrowly avoided falling into a technical recession.

EXPORTS ROSE FOR THIRD CONSECUTIVE MONTH

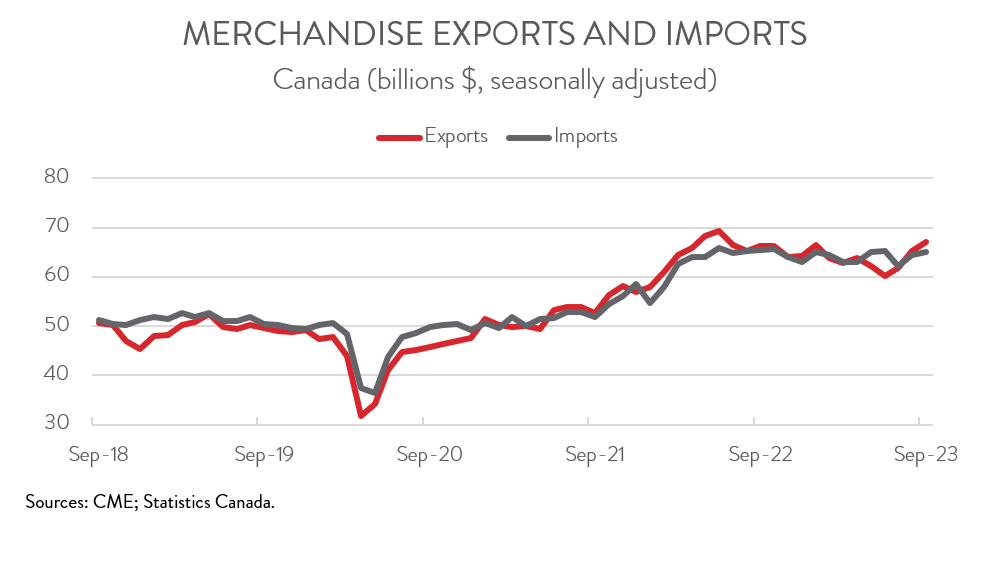

Canada’s merchandise exports increased 2.7% to $67.0 billion in September, the third consecutive monthly gain. Meanwhile, merchandise imports rose 1.0% to $65.0 billion, up for the second month in a row. Trade activity was not quite as impressive in volume terms, with real exports and real imports up 0.2% and 1.1%, respectively.

Net trade appears to have contributed positively to GDP growth in the third quarter, as real exports were up 0.5% and real imports were down 0.3%. As a result, Canada’s economy may have eked out a small gain in Q3 and narrowly avoided falling into a technical recession, defined as two consecutive quarters of falling GDP.

TRADE BALANCE MORE THAN DOUBLED

Canada’s trade balance more than doubled, growing from $949 million in August to $2.0 billion in September. Breaking the numbers down, Canada’s trade surplus with the U.S. widened from $11.0 billion in August to $11.7 billion in September, while our trade deficit with the rest of the world narrowed from $10.1 billion to $9.6 billion.

EXPORT INCREASE DRIVEN BY ENERGY PRODUCTS

The increase in exports spanned 7 of 11 product sections and was driven by higher exports of energy products. In fact, for the second consecutive month, exports of energy products posted a double-digit gain, rising 10.6% to $16.9 billion in September. The increase was largely attributable to higher exports of crude oil, which in turn was mostly due to higher prices.

Non-energy exports were up a much more modest 0.3% in September. Exports of farm, fishing and intermediate food products increased 8.1% to $4.9 billion. Exports of wheat increased the most, as favourable weather conditions accelerated the harvest. Unfortunately, this growth is not expected to last, as overall Canadian wheat production is expected to decline in 2023 and global supplies have improved.

After edging down in August, exports of motor vehicle and parts rose 2.3% to $8.9 billion in September. Auto sector exports climbed 1.5% in the third quarter, the fourth consecutive quarterly increase, coinciding with improving supply chains.

On the negative side, after hitting a record high in August, exports of metal and non-metallic mineral products fell 10.7% to $7.5 billion in September. Exports of unwrought gold, silver, and platinum group metals contributed the most to the decrease.

EXPORTS TO THE U.S. UP FOR THIRD MONTH IN A ROW

Exports to the U.S. rose 2.6% to $52.7 billion in September, up for the third month in a row, as higher exports of energy products more than offset lower exports of gold. At the same time, exports to the rest of the world climbed 2.9% to $14.3 billion. Among Canada’s major non-U.S. trading partners, exports to China, South Korea, and the EU were up, while exports to Japan, the U.K., and Mexico were down. The decrease in exports to the U.K. was driven by gold.