International Trade

Merchandise Trade

October 2023

Canada’s Trade Surplus Widened in October on Lower Imports

HIGHLIGHTS

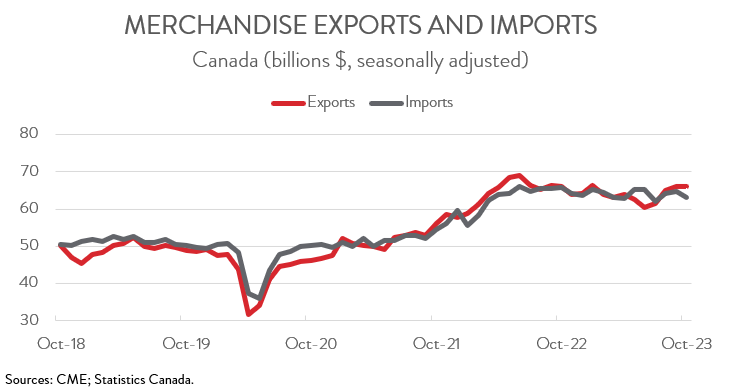

- Canada’s merchandise exports edged up 0.1% to $66.0 billion in October, while imports fell 2.8% to $63.0 billion.

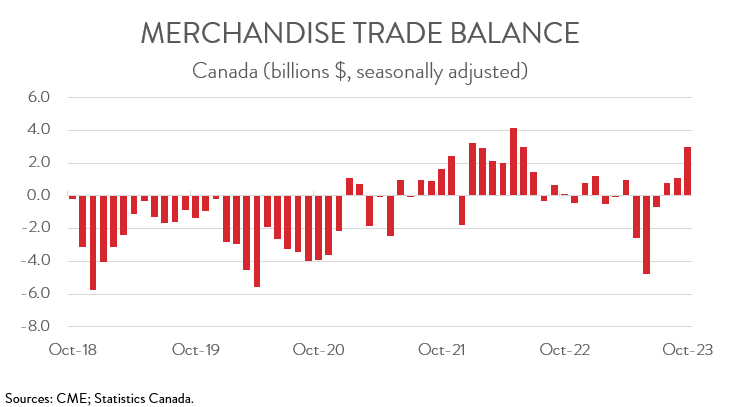

- The country’s trade surplus widened from $1.1 billion in September to $3.0 billion October, the largest since June 2022.

- In volume terms, exports and imports were down 0.2% and 3.7%, respectively.

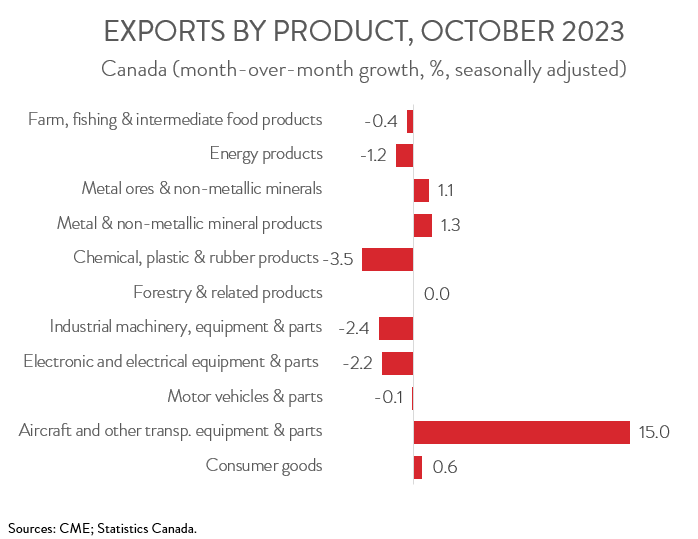

- The increase in nominal exports spanned 5 of 11 product sections, with aircraft and other transportation equipment and parts posting the biggest gain and energy products posting the steepest loss.

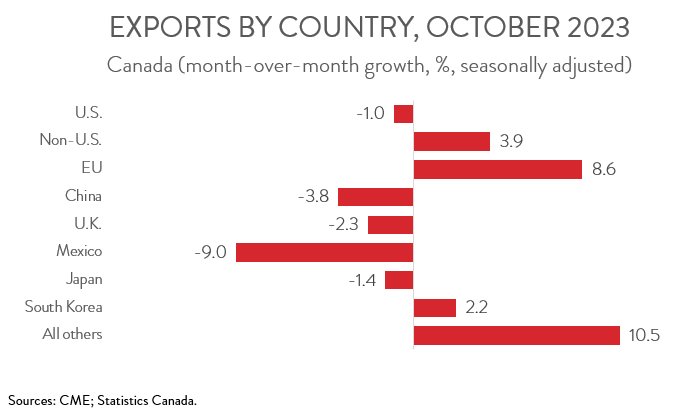

- Exports to the U.S. fell 1.0% to $51.4 billion in October, while exports to the rest of the world climbed 3.9% to $14.6 billion.

- Net trade improved in volume terms in October, raising the odds that foreign demand will contribute positively to GDP growth in the fourth quarter.

EXPORTS EDGE UP IN OCTOBER

Canada’s merchandise exports edged up 0.1% to $66.0 billion in October, the fourth consecutive monthly gain. Meanwhile, merchandise imports fell 2.8% to $63.0 billion, down for the first time in three months. In real (or volume terms), exports and imports were down 0.2% and 3.7%, respectively.

Net trade improved in volume terms in October, raising the odds that foreign demand will contribute positively to GDP growth in the fourth quarter. However, this must be weighed against the fact that imports have been stagnant since March, partly reflecting a sluggish domestic economy.

TRADE BALANCE RECORDS $3.0 BILLION SURPLUS

Canada’s trade surplus widened from $1.1 billion in September to $3.0 billion in October, the largest since June 2022. Breaking the numbers down, Canada’s trade surplus with the U.S. widened for the fourth consecutive month, going from $11.0 billion in September to $12.1 billion in October. At the same time, our trade deficit with the rest of the world narrowed from $9.9 billion to $9.1 billion.

EXPORT INCREASE LED BY AIRCRAFT AND OTHER TRANSPORTATION EQUIPMENT AND PARTS

The increase in exports spanned 5 of 11 product sections. Exports of aircraft and other transportation and parts led the gains, surging 15.0% to $2.9 billion, the fourth increase in five months and the highest level since January 2021. It should be noted, however, that this industry’s trade statistics are notoriously volatile from month to month.

On the negative side, exports of energy products dipped 1.2% to $15.9 billion, down for the first time in four months. The decline was largely attributable to a drop in crude oil exports, following a significant rise in the third quarter.

As well, exports of basic and industrial chemical, plastic and rubber products fell 3.5% to $3.4 billion in October, extending the 3.0% decline seen a month earlier. The decrease was driven by lower exports of lubricants and other petroleum refinery products, due partly to a drop in prices.

Finally, exports of industrial machinery, equipment and parts contracted 2.4% to $4.3 billion in October, the first decline in four months.

EXPORTS TO THE U.S. DOWN FOR FIRST TIME IN FOUR MONTHS

Exports to the U.S. fell 1.0% to $51.4 billion in October, the first decline in four months. Notably, imports from the U.S. were also down, as strike activity by U.S. auto workers resulted in the first decline in imports of motor vehicles and parts since March 2023.

Meanwhile, exports to the rest of the world climbed 3.9% to $14.6 billion in October. Among Canada’s major non-U.S. trading partners, exports to the EU and South Korea were up, while exports to China, Mexico, the U.K., and Japan were down. The increase in exports to countries other than the U.S. was driven by higher exports of other transportation equipment to Saudi Arabia, higher exports of iron ore to the Netherlands, higher exports of unwrought gold to Switzerland, and higher exports of aircraft to Italy.