International Trade

Merchandise Trade

December 2023

Trade Balance Swings into a Deficit as Exports Decline

HIGHLIGHTS

- Canada’s merchandise exports declined 1.9% to $64.1 billion in December, while imports inched up 0.2% to $64.4 billion.

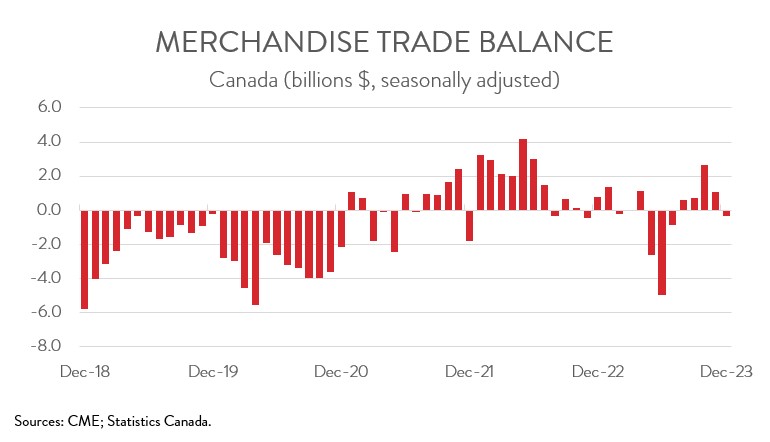

- The country’s trade balance swung into a deficit of $0.3 billion in December, following a surplus of $1.1 billion in November.

- In real (or volume terms), exports and imports were up 0.2% and 0.8%, respectively.

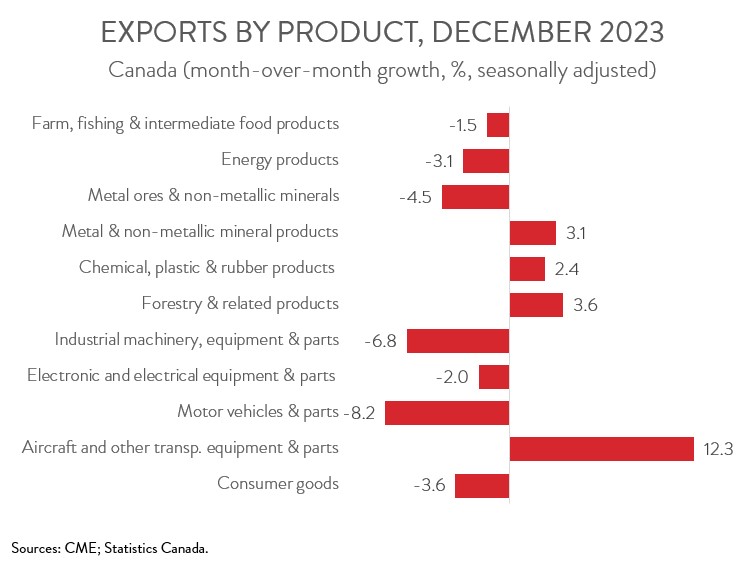

- The decrease in nominal exports spanned 7 of 11 product sections and was driven by lower exports of motor vehicles and crude oil.

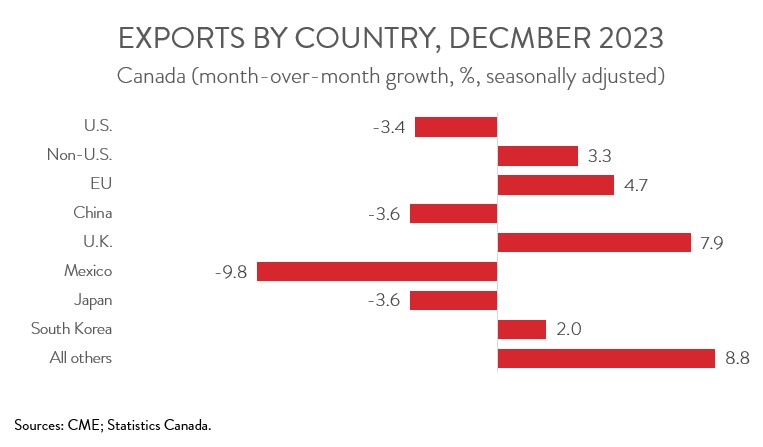

- Exports to the U.S. decreased 3.4% to $49.4 billion in December, while exports to the rest of the world rose 3.3% to $14.7 billion.

- Barring major revisions, net trade will add solidly to growth in the fourth quarter, as real exports jumped 4.3% at an annualized rate in Q4, while real imports declined 1.8%.

EXPORTS FALL FOR SECOND MONTH IN A ROW

Canada’s merchandise exports declined 1.9% to $64.1 billion in December, down for the second month in a row. Meanwhile, merchandise imports inched up 0.2% to $64.4 billion, up for the second straight month. In real (or volume terms), exports and imports were up 0.2% and 0.8%, respectively.

It is important to note that the average value of the Canadian dollar increased 1.5 cents U.S. in December, the largest monthly gain since May 2021, and this contributed to the weak performance of exports. In fact, when expressed in U.S. dollars, Canadian exports edged up 0.1% during the month.

Barring major revisions, net trade will add solidly to growth in the fourth quarter, as real exports jumped 4.3% at an annualized rate in Q4, while real imports declined 1.8%, marking a reversal from the third quarter when foreign demand weighed on the economy. Nevertheless, the near-term trade outlook remains cloudy, as demand for Canadian exports is expected to be held back by slower global economic growth. In addition, potential job action looms at the Port of Montreal. If a strike occurs, it will not only cause immediate economic harm, but it will also deliver another blow to Canada’s reputation as a stable and dependable trading partner.

CANADA RUNS SMALL TRADE DEFICIT IN 2023

Canada’s trade balance swung into a deficit of $0.3 billion in December, following a surplus of $1.1 billion in November. Breaking the numbers down, Canada’s trade surplus with the U.S. narrowed from $11.2 billion in November to $9.2 billion in December. At the same time, our trade deficit with the rest of the world narrowed from $10.1 billion to $9.5 billion.

Turning to annual figures, Canada ran a small trade deficit of $1.4 billion in 2023. This marked a deterioration from the previous two years when the country ran back-to-back surpluses of $2.5 billion and $19.7 billion, respectively, in 2021 and 2022.

EXPORTS WEIGHED DOWN BY MOTOR VEHICLES AND CRUDE OIL

The decrease in exports spanned 7 of 11 product sections. Exports of motor vehicles and parts fell 8.2% to $8.1 billion in December. The decline was driven by lower exports of passenger cars and light trucks, partly attributable to a gradual slowdown in the production of certain models that will soon no longer be manufactured in Canada or that will be shifted to other Canadian plants. Looking ahead, however, many automakers have announced plans to build new models, including electric vehicles, in Canada, boding well for future export growth. Notably, despite the decrease in December, exports of motor vehicles and parts jumped 26.2% in 2023, surpassing $100 million for the first time.

Exports of energy products fell 3.1% to $15.4 billion in December, with crude oil exports contributing the most to the decline. Even though real crude oil exports have increased for five months in a row, they have fallen for two straight months in nominal terms, with concerns of oversupply and weaker demand pushing down prices.

On the positive side of the ledger, exports of aircraft and other transportation equipment and parts soared 12.3% to $2.7 billion in December, up for the third time in four months. For 2023 as a whole, exports climbed 25.5% to a record high of $30.5 billion.

EXPORTS TO THE U.S. DECLINE FOR THIRD STRAIGHT MONTH

Exports to the U.S. decreased 3.4% to $49.4 billion in December, falling for the third consecutive month. In contrast, exports to the rest of the world rose 3.3% to $14.7 billion, partly making up for a 4.5% decrease in the previous month. Among Canada’s major non-U.S. trading partners, exports to the EU, the U.K., and South Korea were up, while exports to China, Mexico, and Japan were down. The increase in exports to countries other than the U.S. was propelled by higher exports of aircraft and pharmaceutical products to Italy, unwrought gold to Hong Kong, and nickel to Norway.