International Trade

Merchandise Trade

January 2024

Canada Records Trade Surplus in January as Imports Plunge

HIGHLIGHTS

- Canada’s merchandise exports declined 1.7% to $62.3 billion in January, while imports plunged 3.8% to $61.8 billion.

- The country’s trade balance swung into a surplus of $496 million in January, following a deficit of $863 million in December.

- In real (or volume terms), exports and imports were down 2.2% and 3.8%, respectively.

- The decrease in nominal exports was widespread, spanning 8 of 11 product sections, with exports of metal and non-metallic mineral products posting the largest decline.

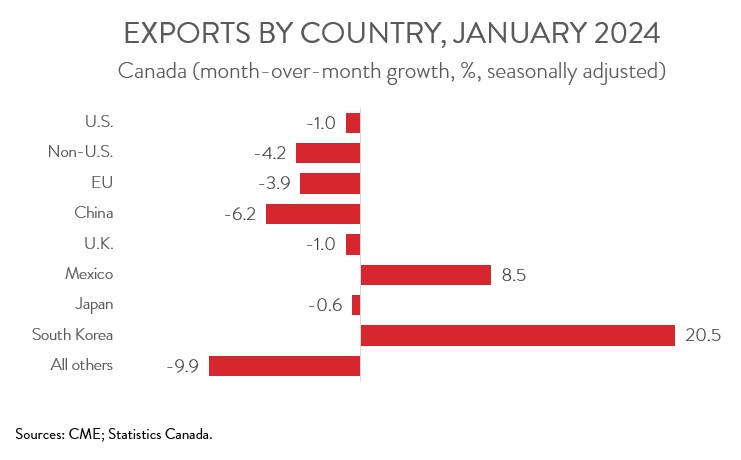

- Exports to the U.S. decreased 1.0% to $48.1 billion in January, while exports to the rest of the world fell 4.2% to $14.1 billion.

- While a trade surplus is often viewed positively as a sign for a country’s economy, today’s report is not one of those situations. Indeed, the January surplus came about because imports fell more steeply than exports, a potential sign of weakening demand both at home and abroad.

EXPORTS FALL FOR THIRD MONTH IN A ROW

Canada’s merchandise exports declined 1.7% to $62.3 billion in January, down for the third month in a row. Meanwhile, merchandise imports plunged 3.8% to $61.8 billion, the lowest level in nearly two years. In real (or volume terms), exports and imports were down 2.2% and 3.8%, respectively.

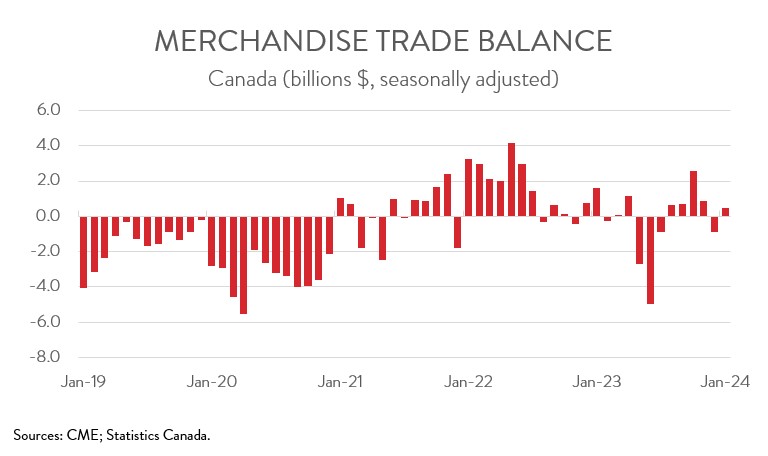

TRADE BALANCE IMPROVES TO A SURPLUS

Canada’s trade balance swung into a surplus of $496 million in January, following a deficit of $863 million in December. Digging into the details, the country’s trade surplus with the U.S. widened slightly from $8.6 billion in December to $8.8 billion in January. At the same time, our trade deficit with the rest of the world narrowed from $9.4 billion to $8.3 billion.

While a trade surplus is often viewed positively as a sign for a country’s economy, today’s report is not one of those situations. The January surplus came about because imports fell more steeply than exports, a potential sign of weakening demand both at home and abroad. Indeed, higher borrowing costs have prompted Canadian consumers and businesses to curb their spending, including on goods from overseas, leading to sluggish economic activity.

DECLINE IN EXPORTS WIDESPREAD ACROSS PRODUCT SECTIONS

The decrease in exports spanned 8 of 11 product sections. Exports of metal and non-metallic mineral products fell the most, down 6.2% to $7.0 billion in January. The declines were broad-based across subsectors and included unwrought gold, silver, and platinum group metals; waste and scrap of metal; basic and semi-finished products of non-ferrous metals and non-ferrous metal alloys; and unwrought nickel and nickel alloys.

At the same time, exports of aircraft and other transportation equipment and parts dropped 13.9% to $2.3 billion, more than erasing the 11.1% gain in December. The decline was driven by lower exports of aircraft. However, as mentioned in previous reports, this industry’s trade statistics are notoriously volatile from month to month, so January’s steep decline is not necessarily indicative of underlying business trends.

Declines in those sectors were partly offset by moderate gains in exports of consumer goods (+3.6%) and exports of motor vehicles and parts (+2.6%). Despite the advance in January, exports from the auto sector have fallen by 3.3% over the last 12 months.

EXPORTS TO THE U.S. DECLINE FOR FOURTH STRAIGHT MONTH

Exports to the U.S. decreased 1.0% to $48.1 billion in January, down for the fourth consecutive month. The decline was largely due to lower exports of aircraft.

Exports to the rest of the world fell 4.2% to $14.1 billion in January, the second decline in three months. Among Canada’s major non-U.S. trading partners, exports to China, the EU, the U.K., and Japan were down, while exports to South Korea and Mexico were up. The decrease in exports to countries other than the U.S. was largely driven by lower exports of aircraft and pharmaceutical products to Italy, coal to China, nickel to Norway, and crude oil to Germany.